Overview

This process guide describes the procedure that should be followed when the Financial Periods for an organisation change and it is necessary to make the changes in BusinessCraft. The change in Financial Periods could involve:

A change in Financial Year End. For example, from June to December.

A change in the Starting and Ending Dates for Financial Periods

A change in the Financial Period structure for example from Monthly to 4,4,5.

The number of periods in a Year

Regardless of the source of the change, this guide describes the process to follow for each dataset whenever the Starting and Ending Dates for Financial Periods need to change.

The process can be carried out at any time and is not restricted to only being carried out after month end has been completed.

If the Change of Financial Period Dates also involves increasing the number of periods in one or more years, it is important to ensure that any existing General Ledger Report Writer reports are updated to cater for 13 periods or complemented with new reports catering for 13 periods. This is also important when cross-checking the impact of the change to 13 periods before allowing users to log back in to BusinessCraft.

It is good practice to import all transactions from other modules and post to the General Ledger after users have been locked out and before the backup is carried out. However, this is not essential as the Import and Post process if carried out after the periods have been changed will simply use the new starting and ending dates.

The Key Process Milestones are:

Carry out a Trial Run General Ledger Integrity Check and fix any errors.

Lock users out of dataset and copy the dataset as an archive dataset, named appropriately

Make required changes to Financial Periods.

Carry out a Non-Trial General Ledger Integrity Check and fix any errors.

Run required Financial Reports and check changes are correct.

Change Year/Period in General Ledger setup.

Allow users to login and continue processing.

Integrity Check – Trial Run

The General Ledger Integrity Check, when run in non-Trial mode, is used to ensure all General Ledger Transactions for Financial Years that have not been closed are allocated to the correct financial period.

The General Ledger Integrity Check should be run in Trial Run mode to identify any potential errors that should be fixed prior to commencing the Change Financial Period process. When run in Trial Mode, financial transactions are not re-allocated.

The General Ledger Integrity Check should be run in Trial Run mode well in advance of carrying out the Financial Period Change so that all data errors are addressed and the time that the system is unavailable to users is minimised.

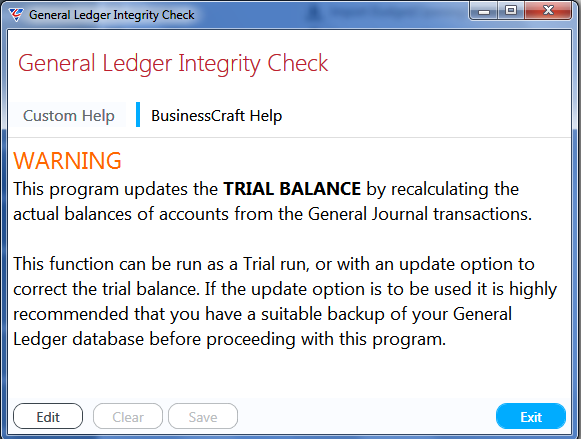

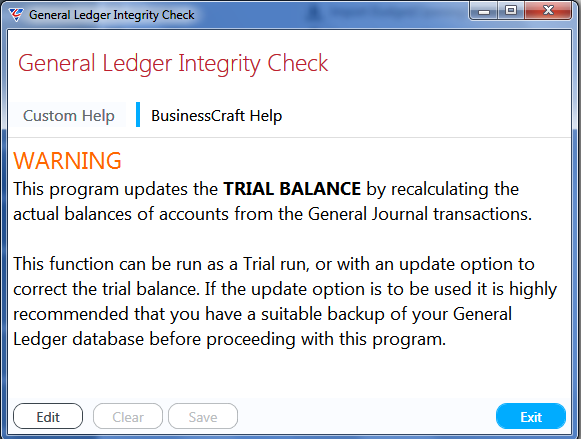

Go to General Ledger > Setup > Integrity Check and a warning screen is presented outlining the nature of the integrity check and that a backup should be taken before using non-trial mode.

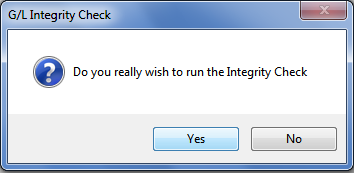

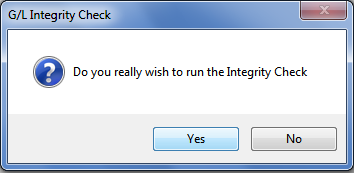

After exiting the Warning screen, a prompt is provided to confirm whether to proceed with the Integrity Check:

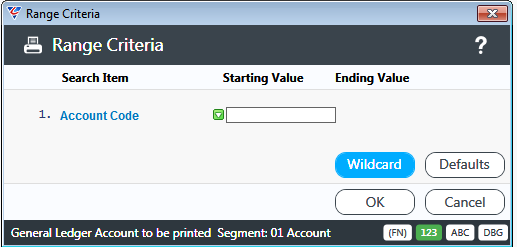

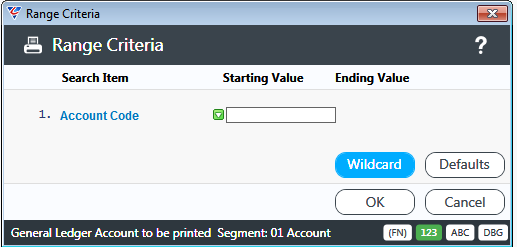

After confirming to proceed, a Range Criteria screen provides the option to limit the Integrity Check to specific accounts:

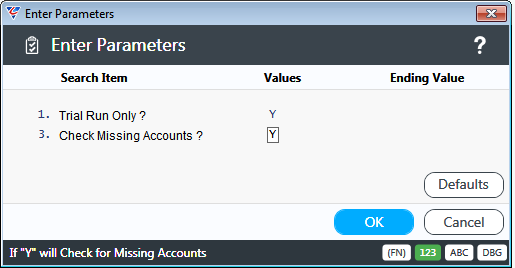

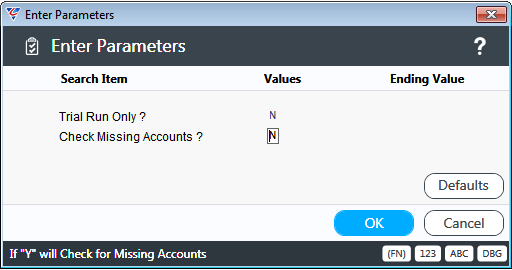

Do not limit the Integrity Check as all accounts need to be included, click OK and a Parameters screen is displayed. Ensure Trial Run Only and Check Missing Accounts are both set to Y. Click OK.

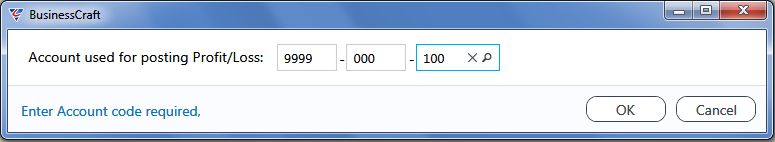

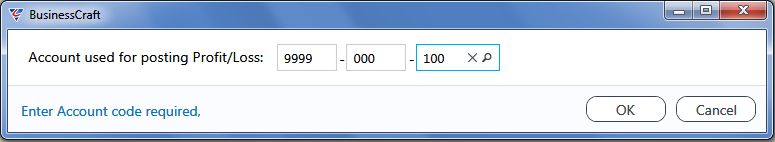

The system prompts for the Retained Earnings General Ledger Account and although needing to be provided is not used for the Trial Integrity check:

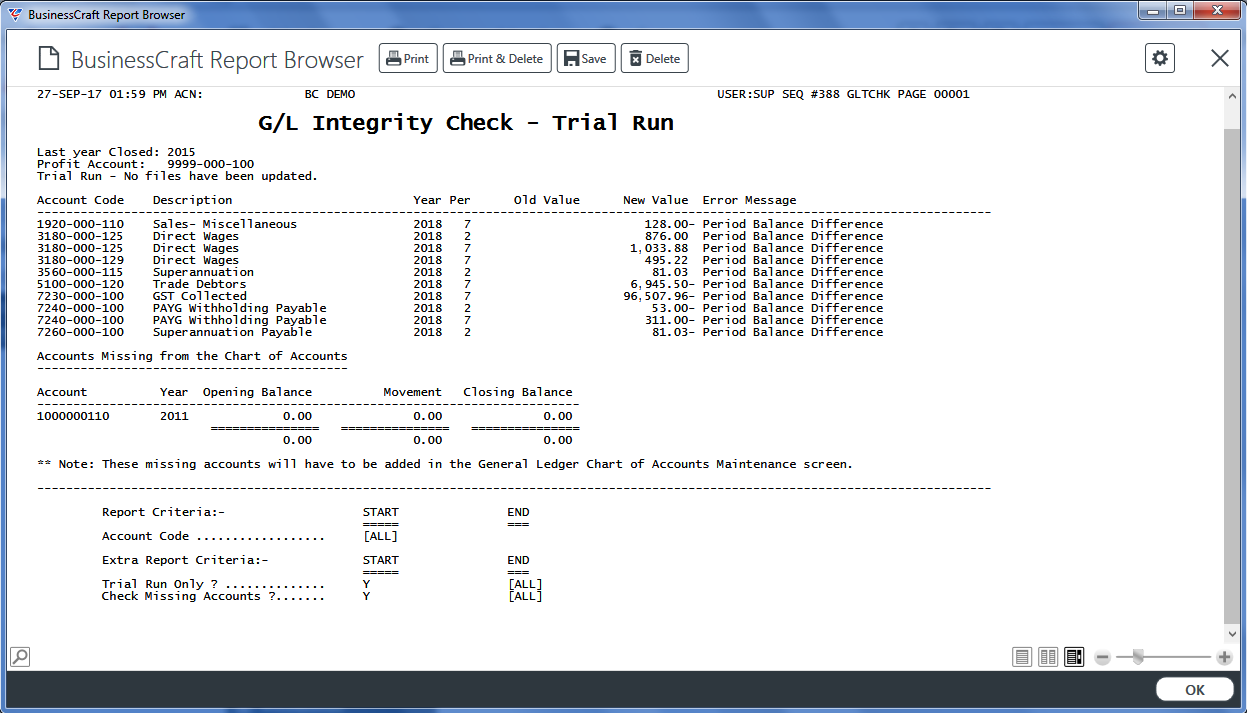

Click OK and the G/L Integrity Check – Trial Run report is displayed. Fix Missing Accounts but Period Balance Differences can be ignored.

Lock Users out of the Dataset and Backup

Before proceeding further, lock users out of the dataset and make sure the dataset is backed up so that an archive dataset can be accessed after the financial period changes have been made to the Live Dataset.

Change Financial Periods

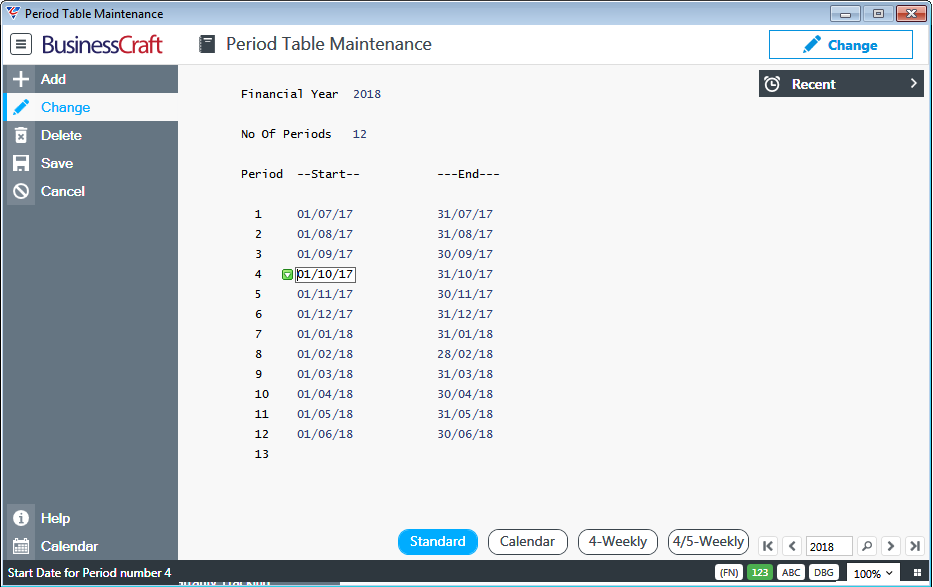

Processing has occurred up to and including October 2017 (currently Period 4 in Year 2018) as shown:

Change the Financial Periods for 2018

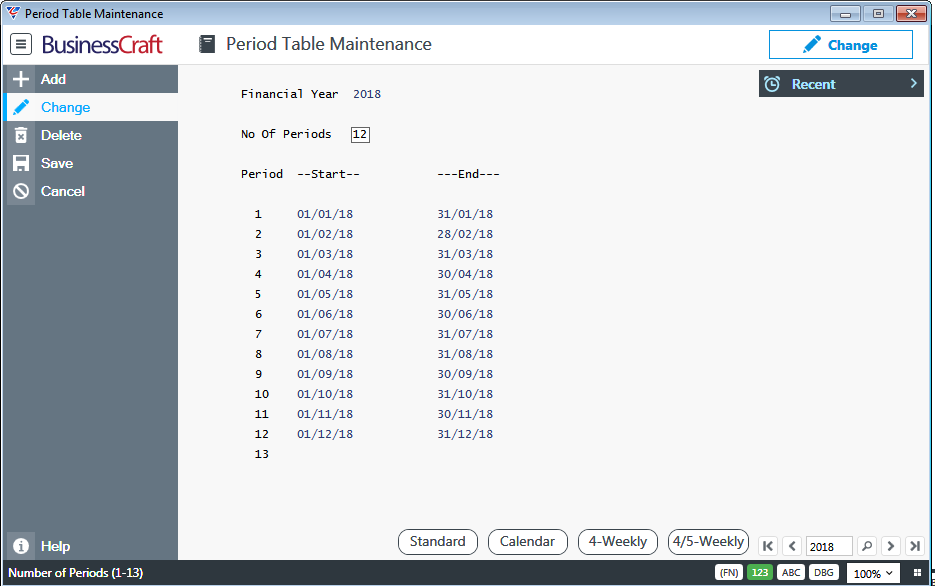

Go to General Ledger > Tables > Periods, find year 2018 and activate the Calendar (F6) function key to change the financial periods to calendar dates with the year ending 31st December 2018:

Change the Financial Periods for 2017

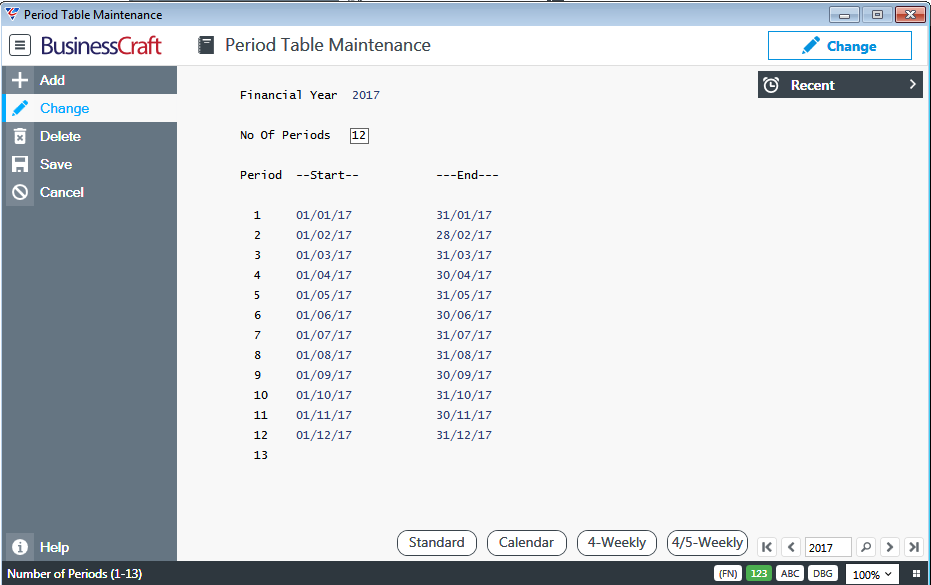

Go to General Ledger > Tables > Periods, find year 2017 and activate the Calendar (F6) function key to change the financial periods to reflect monthly calendar dates with the year ending 31st December 2017:

Change the Financial Periods for 2016

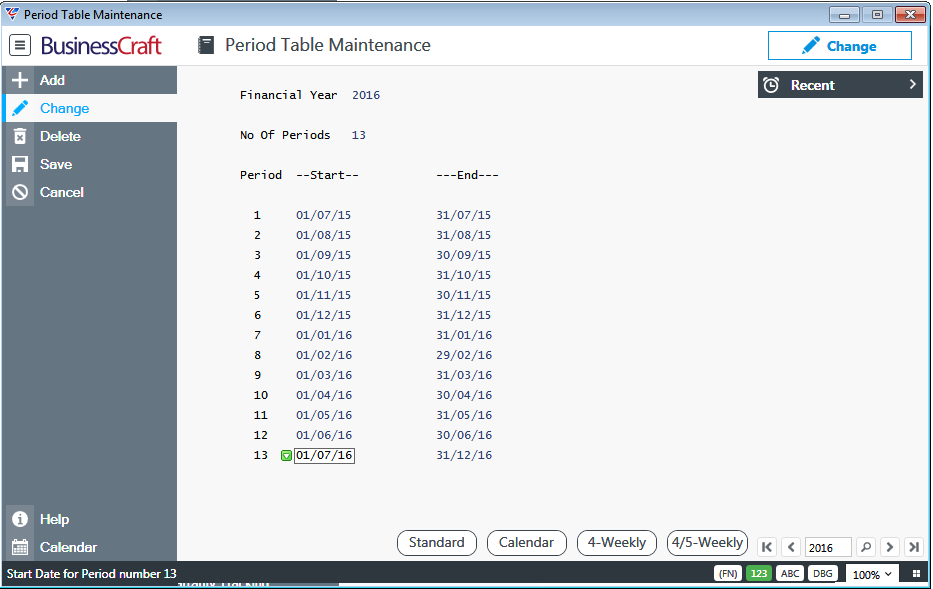

Go to General Ledger > Tables > Periods, find year 2016, change the No of Periods field from 12 to 13 and enter 01/07/16 in the Start Field for Period 13 and 31/12/16 in the End Field for Period 13:

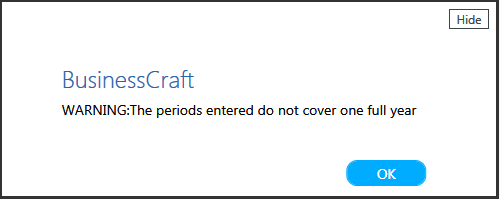

On exiting the Period Table Maintenance screen, a warning is provided that the 2016 Year is not a full year (this message is provided whether more than or less than 12 months are covered):

Click OK to acknowledge the warning.

Integrity Check - Live Run

The General Ledger Integrity Check now needs to be run in non-Trial Run mode to ensure all General Ledger Transactions for Financial Years that have not been closed are re-allocated to the correct financial period.

Go to General Ledger > Setup > Integrity Check and a warning screen is presented outlining the nature of the integrity check and that a backup should be taken before using non-trial mode.

After exiting the Warning screen, a prompt is provided to confirm whether to proceed:

After confirming to proceed, a Range Criteria screen provides the option to limit the Integrity Check to specific accounts. Do not limit the Integrity Check as all accounts will need to be included. Click OK.

In the Parameters screen that is displayed, ensure that Trial Run Only and Check Missing Accounts are both set to N and click OK:

The system prompts for the Retained Earnings General Ledger Account which is adjusted to ensure the Retained Earnings account remains consistent with the financial period changes made:

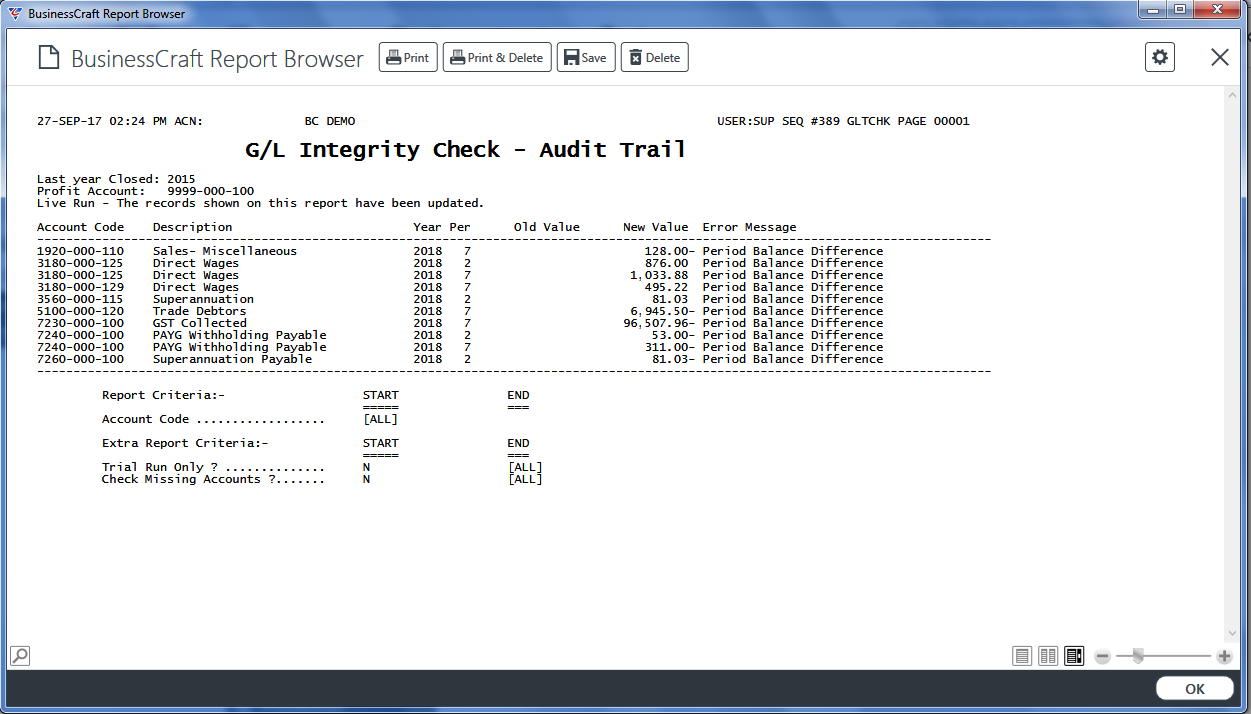

Click OK and the G/L Integrity Check – Audit Trail report displays any errors that were corrected.

Period Balance Differences are displayed to indicate where an account balance was found to be incorrect and was adjusted from the Old Value to the New Value. The Integrity Check not only ensures that transactions are allocated to the correct period but also that the Account Balances are consistent with the detailed transactions.

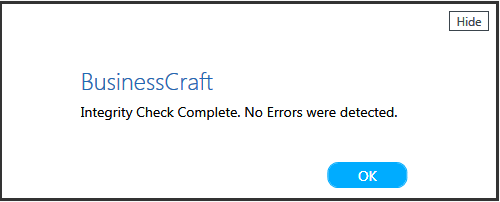

If no errors were found and corrected, the following message is displayed.

Click OK.

Run Financial Reports and Check Results

Run required financial reports, remembering that the Financial Periods have changed and check that results expected are correct. If not, recover the Live dataset using the back-up that was taken earlier in the process.

General Ledger Current Year and Period Fields

Go to General Ledger > Setup > General Ledger Setup and change the Current Fiscal Year and Current Period fields to reflect the Current Year and Period based on the Financial Period changes made.

Allow Users to Login

Allow users to login back in and continue processing.

Revision 1

27th September 2017