Overview

This short guide explains how to update PAYG Withholding Tax Tables (Tax Tables) manually either when the Year End Tax Table update fails or when the ATO releases intermediate Tax Tables during a Payroll Year.

Installed Tax Tables

The Tax Tables in the BusinessCraft Payroll Module are used to determine the PAYG Tax to be applied to payments calculated in the payroll process excluding Manual Payments.

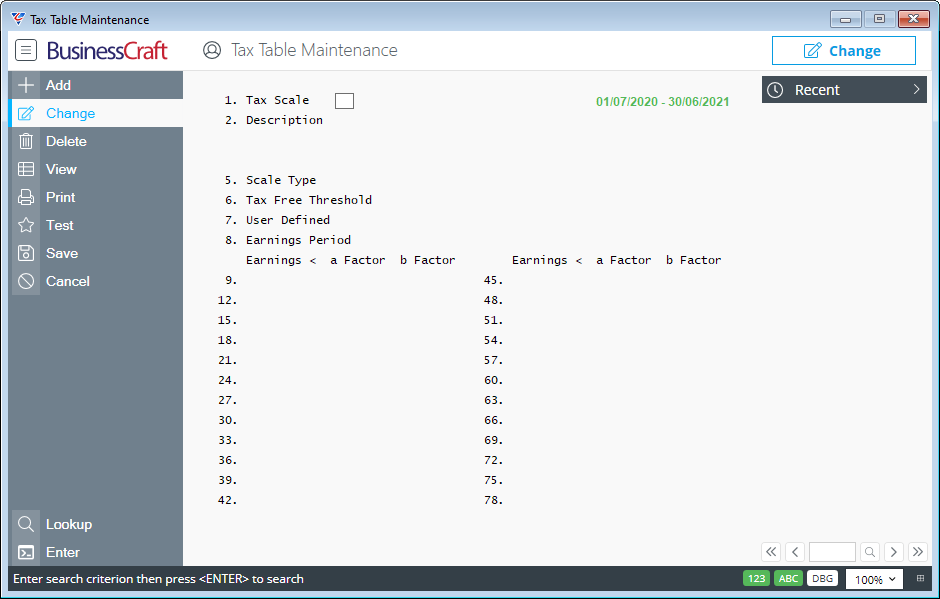

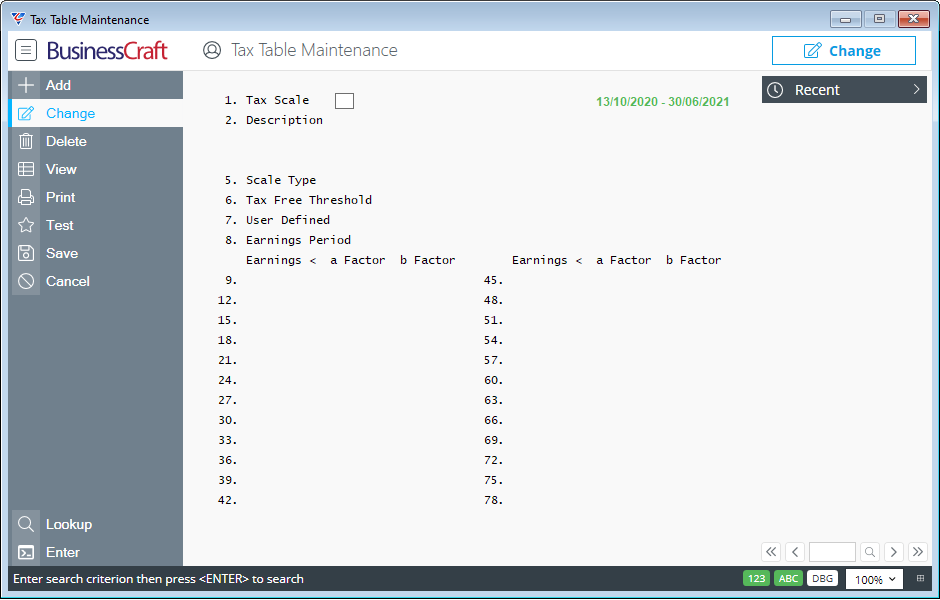

To examine the Tax Tables currently installed, go to Payroll > Tables > Tax Tables and the Tax Table Maintenance screen is displayed:

Whilst records can be added, changed and even deleted, this is not recommended other than under exceptional circumstances.

BusinessCraft provides Tax Tables based on information released by the ATO. Every attempt is taken to ensure the Tax Tables supplied mirror the thresholds, coefficients and factors supplied by the ATO accurately.

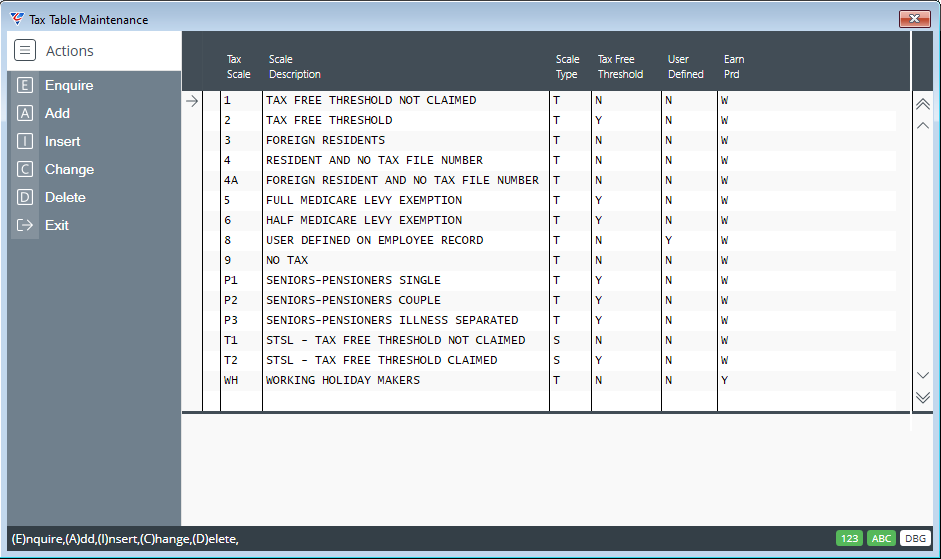

Use the View option in the Menu Sidebar to see all the Tax Scales currently available:

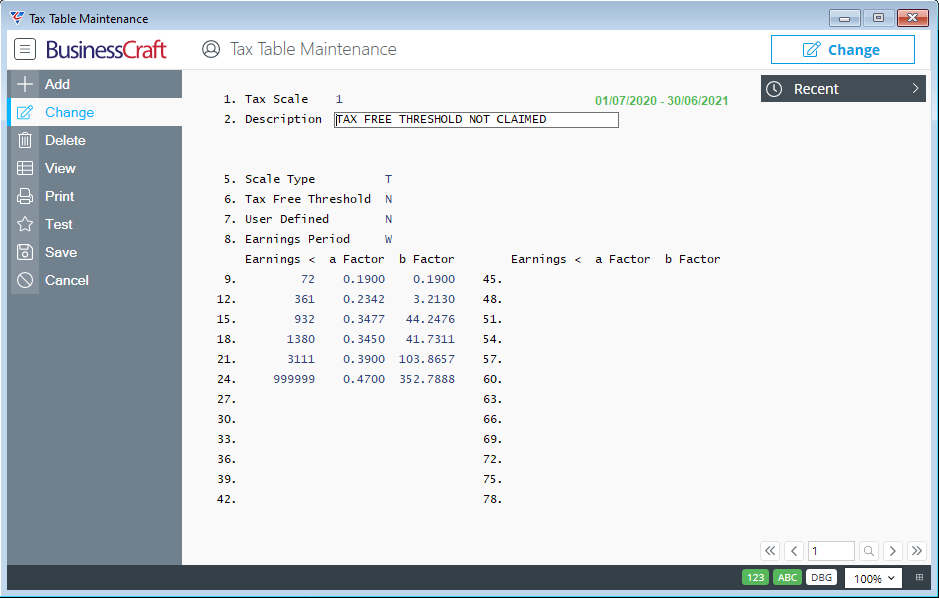

Use the Enquire option in the Menu Sidebar to review full details for the selected record - here is an example of Tax Scale 1 for the Period 01/07/2020 through to 30/06/2021:

Updated Tax Tables

BusinessCraft will generally make new Tax Tables available as part of a Product Update. When this is the case, the Tax Tables will either be installing immediately as part of the Product Update or in readiness for Payroll Year End when the Tax Tables will be updated as part of that process.

In some circumstances, the ATO will release Tax Tables during a Payroll Year with the requirement that the Tax Tables are to become effective from a specific payment date.

When this occurs, timeframes for the application of those Tax Tables, makes it not feasible to require customers to install a Product Update within a restrictive time frame purely to obtain updated Tax Tables for Payroll purposes. In these circumstances, BusinessCraft will notify customers of the availability of new Tax Tables and will either include those Tax Tables with the notification or advise how to obtain the Tax Tables.

In this situation (and where an automatic Tax Table update during Payroll Year End fails), it is necessary to install the Tax Tables manually as explained in this guide.

Tax Tables Structure

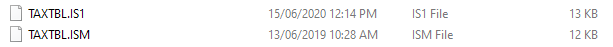

The BusinessCraft Tax Tables comprise two tables – TAXTBL.IS1 and TAXTBL.ISM - these tables are located in the BusinessCraft > xfSvr folder for each BusinessCraft Dataset that is used:

When Tax Tables need to be installed manually, they will usually be made available in a Compressed File that will need to be decompressed into the two files.

If at this point, this is becoming too technical or you don’t know where the xfSvr folder is, then do not proceed. Instead log a Service Request with us on the BusinessCraft Service Portal (if you have authorised access) or send an email to the BusinessCraft Services Team.

Updating Tax Tables

Once the new Tax Tables have bene obtained, the following process needs to be carried out for each BusinessCraft Dataset:

Backup the existing installed Tax Tables

Go to the xfSvr folder for the required dataset, copy the existing TAXTBL.IS1 and TAXTBL.ISM files to a suitable backup/archive location. Ideally compress the files and name the Compressed File suitably. For example “2021 Tax Tables prior to October 2020 Update”.

Copy the new Tax Tables into the required dataset

Go to the xfSvr folder for the required dataset, and copy the new TAXTBL.IS1 and TAXTBL.ISM files to replace the existing files backed up in the previous step.

Check the new Tax Tables are visible in the required dataset

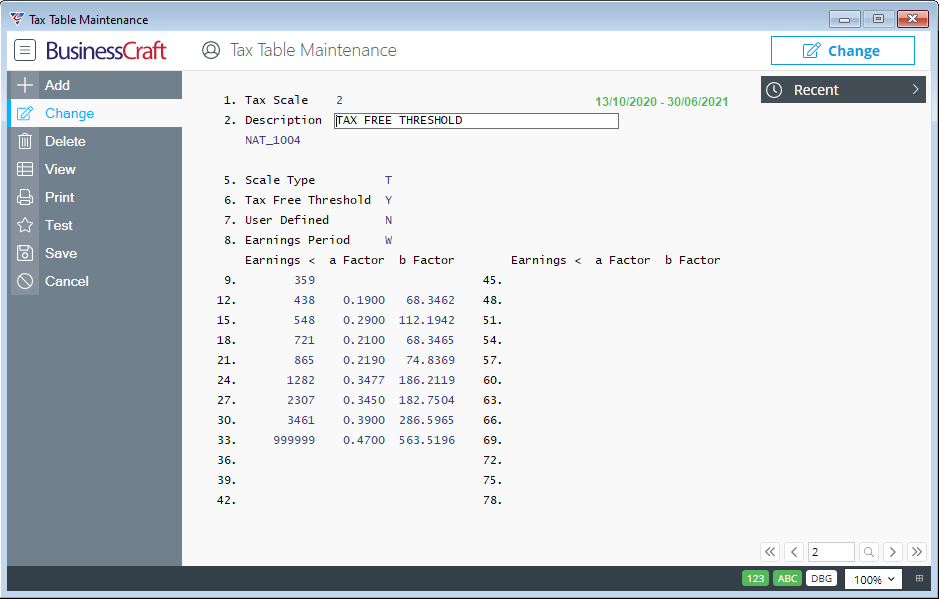

To examine the Tax Tables just installed, go to Payroll > Tables > Tax Tables and the Tax Table Maintenance screen is displayed. Check the date range to ensure that the new tables are visible:

From the October 2020 Tax Tables onwards, BusinessCraft includes the ATO NAT Form number that was the source of the Tax Table information in the description:

Revision 1

14th October 2020