Transition to Single Touch Payroll Phase 2

Introduction

In the 2019–20 Budget, the Government announced that Single Touch Payroll (STP) would be expanded to include additional information.

This expansion of STP (STP Phase 2) intends to reduce the reporting burden for employers who need to report information about their employees to multiple government agencies. STP Phase 2 also supports the administration of the social security system.

The current mandatory start date for STP Phase 2 reporting is 1 January 2022.

While additional information is required to be supplied in STP Phase 2, there are many things that have not changed, such as:

The way the STP Phase 2 report is lodged

STP Phase 2 reports are still due on or before pay day unless a reporting concession applies

The types of payments that are to be included in STP Phase 2 (more detail is now required)

Taxation and Superannuation obligations

End of Year Finalisation Requirements.

Key changes in STP Phase 2

The additional information required by STP Phase 2 is captured by BusinessCraft provided the system has been updated to the required version and the configuration steps explained in this document are followed.

The key changes in STP Phase 2 include:

Disaggregation of Gross

Currently STP reporting includes a gross amount, which is the total of many different components and payment types. Because some of these components are treated differently for social security purposes, STP Phase 2 requires them to be reported in more detail.

The STP Phase 2 report separately itemises the following components of the gross amount:

Allowances

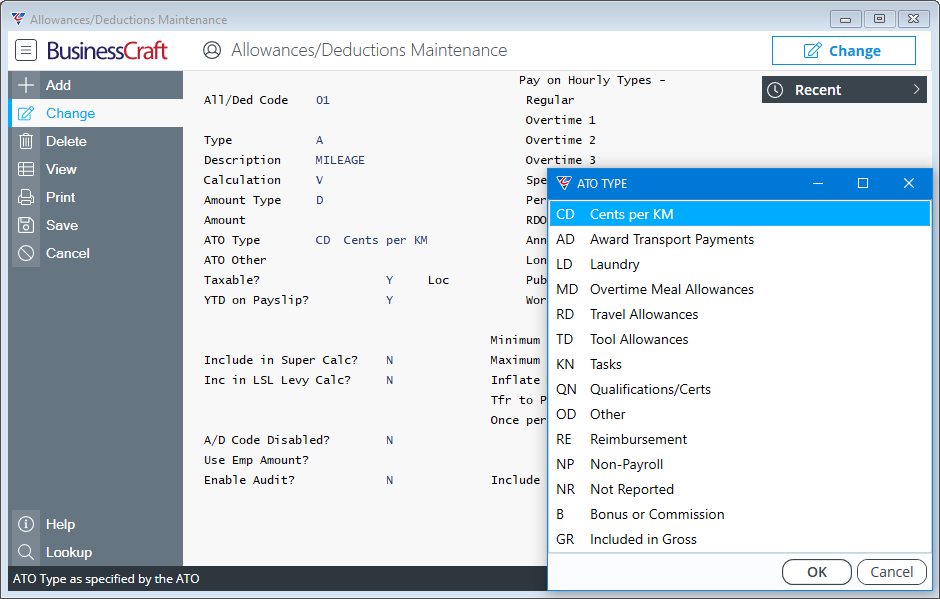

In STP Phase 1 reporting, some allowances are reported separately, and some are reported as part of gross.

With STP Phase 2 all allowances must be reported separately, not just expense allowances that may have been deductible on the employee’s individual income tax return.

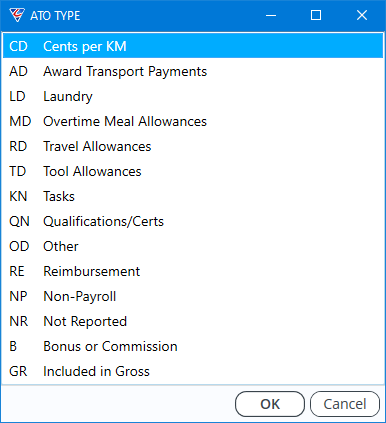

Each allowance must now be classified strictly in accordance with the STP Phase 2 permissible ATO Types. BusinessCraft displays the available ATO Types which now include:

Detailed help is available from the ATO Type field on each of these choices.

The Reimbursement option enables the reimbursement of non-payroll expenses to employees through payroll with no impact on STP Reporting.

The Non-Payroll option provides the ability to record an Allowance for display purposes (primarily on pay slips) to indicate an amount contributed for the employee to a 3rd Party and will not be included in the employee’s pay or reported as income in STP Reporting.

The Not Reported option is used for allowances paid where the amount is less that the Reasonable Allowance amount as defined by the ATO.

The Bonus or Commission option caters for recurring bonuses or commissions that would be cumbersome to otherwise set up as Special Hours Codes.

The Included in Gross option should be used with care and caters for situations where an Allowance Code needs to be used, however the payment is not an allowance and would be considered by the ATO to be part of normal earnings.

Bonuses and Commissions

Bonuses or commission payments made to employees in addition to their salary or wages must be reported as a separate component in STP Phase 2. This will require the use of a Special Hours Code in BusinessCraft with the correct Special Hours Code Type selected.

Alternatively, where the Bonus or Commission is of a recurring nature and it would be cumbersome to enter Special Hours Codes for each pay period, BusinessCraft has provided the option to create Allowances for Bonuses or Commissions. It is critical to ensure the Bonus or Commission ATO Type is selected for those Allowances.

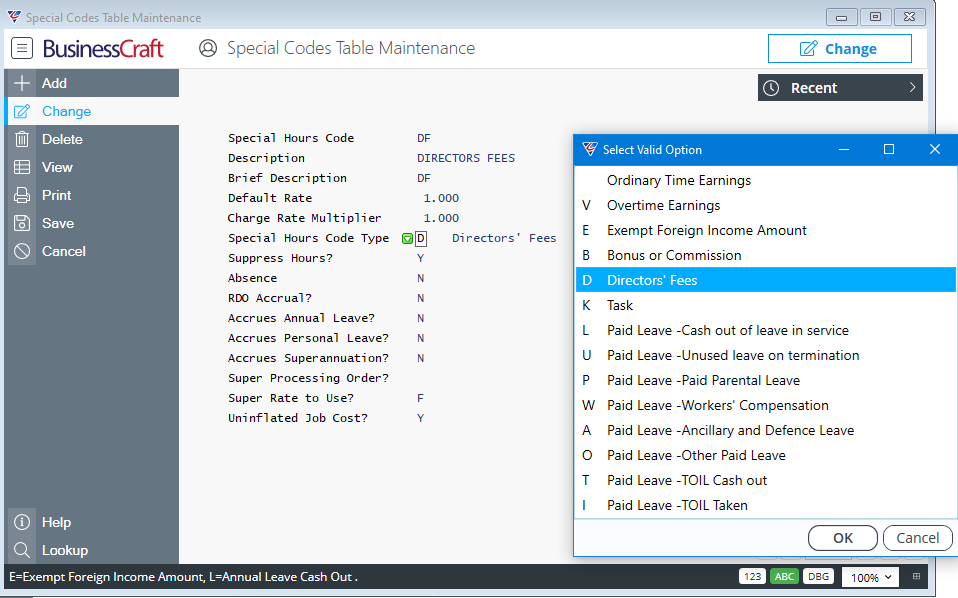

Directors' Fees

Directors' fees paid to the directors of the company, must be reported as a separate component in STP Phase 2. This will require the use of a Special Hours Code in BusinessCraft with the correct Special Hours Code Type selected. Flexibility is provided to Suppress Hours and just record an Amount instead of Hours with a Rate.

Overtime

Overtime Amounts paid to an employee must be reported as a separate component in STP Phase 2. BusinessCraft does this automatically in the background provided overtime is recorded in the correct fields. If a Special Hours Code is used for an Overtime related requirement, then that Special Hours Code must use the Overtime Earnings Special Hours Code Type.

Paid Leave

Leave paid to employees must be reported as a separate component in STP Phase 2. This includes the type of paid leave in accordance with the following Paid Leave Types:

Ancillary and Defence Leave

Cash Out of Leave in Service

Other Paid Leave

Workers' Compensation.

Ancillary and Defence Leave

This includes amounts paid to employees engaged in activities such as jury service, service with local fire or emergency authorities, or service in the Australian Defence Force. This will require the use of Special Hours Codes in BusinessCraft with the correct Special Hours Code Type.

Cash Out of Leave in Service

This includes amounts paid out of leave entitlements in lieu of the employee taking the absence from work. This will require the use of Special Hours Codes in BusinessCraft with the correct Special Hours Code Type.

Time off in Lieu that is cashed out instead of the employee taking that Time Off has a specific Special Hours Code Type to be used. Time off in Lieu taken has a specific Special Hours Code Type as well – see the Other Paid Leave section below)

Other Paid Leave

This includes all paid absences unless they are included in one of the other paid leave types. Other Paid Leave includes the common types of payments relating to leave taken such as Annual Leave, Annual Leave Loading, Long Service Leave, and Personal Leave, but excluding Workers Compensation, Paid Parental Leave, Time Off in Lieu and Unused Leave Paid on Termination.

Other paid leave will only require the use of a Special Hours Code in BusinessCraft with the correct Special Hours Code Type selected when the Leave is not recorded in the Standard Leave fields provided in BusinessCraft. (BusinessCraft will automatically apply the correct Paid Leave Type in normal paid leave scenarios).

Workers' Compensation

This category covers all workers’ compensation payments made to an injured employee including payments for hours not worked (or not attending work as required) or if the employment has been terminated.

Workers Compensation will only require the use of a Special Hours Code in BusinessCraft with the correct Special Hours Code Type selected when the Workers Compensation is not recorded in the standard fields provided in BusinessCraft. (BusinessCraft will automatically apply the correct Paid Leave Type in normal paid workers compensation scenarios).

Salary Sacrifice

Changes to superannuation guarantee law that apply from 1 January 2020 mean that salary sacrifice contributions can no longer:

be used to reduce ordinary time earnings other than for PAYG Tax calculation

count towards minimum superannuation guarantee obligations.

With STP Phase 2, Salary Sacrifice deductions must be reported separately. When setting up Salary Sacrifice deductions, there are two new ATO Type fields to choose from:

Salary Sacrifice - Superannuation

Salary Sacrifice - Other Employee Benefits.

This also means that employees who sacrifice 100% of their income will now be included in STP Phase 2 reporting when the Salary Sacrifice deduction is correctly configured.

Detailed help is available from the ATO Type field in the Allowances/Deductions screen.

Employment Conditions

Employment conditions information is already supplied as part of STP Phase 1 through the STP report submitted to the ATO. This includes the employee’s commencement and termination date and Tax File Number (TFN) related information.

The extra information that will now be submitted as part of STP Phase 2 will mean that TFN declarations will no longer be required to be sent to the ATO. However, they will need to be kept with employee records.

The extra information supplied as part of STP Phase 2 includes:

Termination Date and Cessation Type

When employees leave employment, reporting their termination date and the cessation type eliminates the need to provide separation certificates.

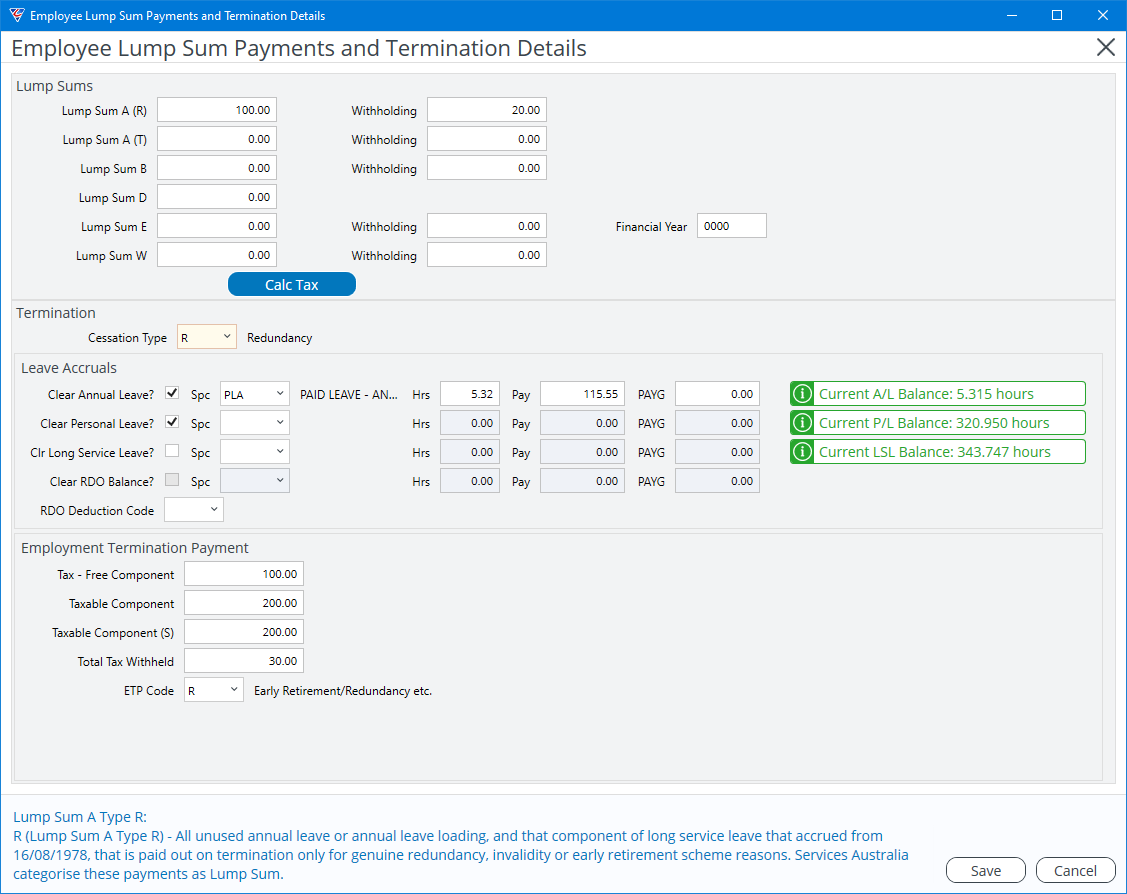

When terminating an employee, BusinessCraft has always provided a Termination Date field within the Manual Payment Entry screen. BusinessCraft now provides a Cessation Type field on the Employee Lump Sum Payments and Termination Details screen within the Manual Payroll Transaction Entry screen enabling the Cessation Type to be selected.

If another payment is made to that employee (for example an ETP), the Termination date does not need to be updated unless it changed.

If that employee is re-hired using the same BusinessCraft Employee Number, STP Phase 2 does not need the termination date to be reported again, even if the employee is re-hired under a different ABN or branch within the same group. However, we recommend clearing the Cessation and Termination Date fields in the Employee Master screen besides changing the Active field to Y.

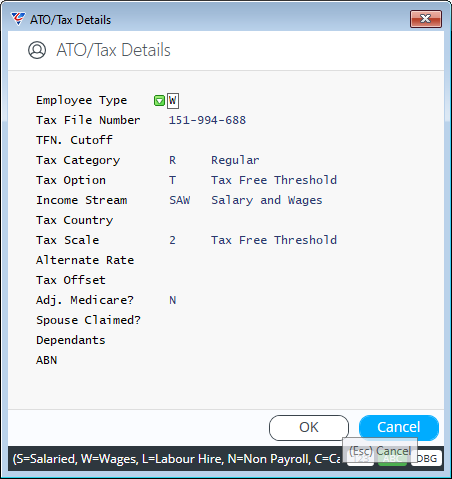

Employee Type

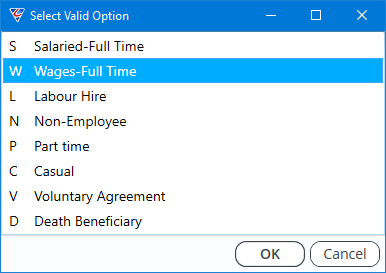

Employee Type has always been a mandatory field in BusinessCraft, however new fields (Tax Category, Tax Option, and Income Stream) in STP Phase 2 replace the importance of the Employee Type. BusinessCraft is retaining this field for now in case it is being used by customers for non-STP reporting purposes.

Valid Employment Types have been updated for STP Phase 2 as follows:

Non-Employee can be used, for example, for those not in scope of STP for payments but may be voluntarily included in STP for superannuation liability reporting only.

Tax Treatment

There are many factors used to determine the correct PAYG amount to withhold from employees. This is based on the information the employee provides in their TFN declaration and other information they have provided.

STP Phase 2 requires the reporting of additional information to support the PAYG amount withheld for each employee as well as the elimination of the need to submit TFN declarations to the ATO.

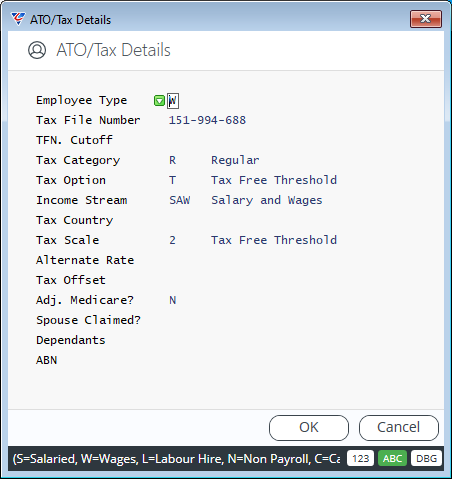

BusinessCraft has redesigned the Employee Master screen to cater for these requirements with the new and existing ATO related information combined into an ATO/Tax Details screen accessed from the ATO/Tax (F6) function button. Each selection determines the available options in some of the other fields and at times will provide prompts to change settings in other fields to correct data:

New fields that require specific attention include –

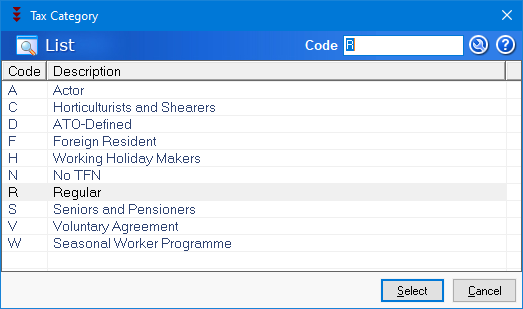

Tax Category

Tax Option

Income Stream

Tax Country

Tax Category

Each employee must be assigned to a Tax Category :

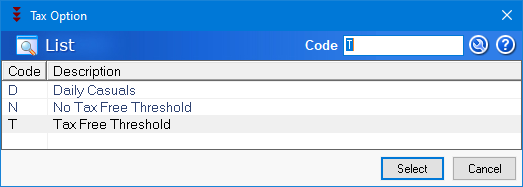

Tax Option

Each employee must be assigned to a Tax Option :

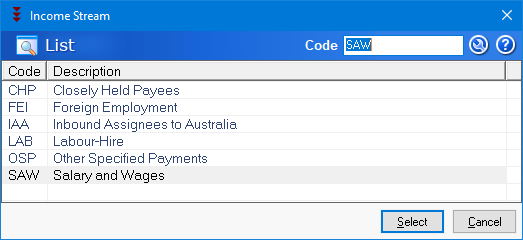

Income Stream

The reporting of income streams is being introduced to:

identify payments made to employees with specific tax consequences

make it easier for employees to complete their individual income tax return

help the ATO identify when a concessional reporting arrangement is being used

Current permitted income streams are:

For full details on the permitted income streams and their purpose please refer to the ATO Web site. Common income streams that are likely to be used by our customers are:

Salary and Wages (SAW) — this is the most common income stream otherwise known as Individual non-business (INB) income

Working Holiday Makers (WHM) — this income type identifies where the individual being paid is subject to the different tax rates which apply for working holiday makers.

Country Codes

In some circumstances, the country code is required. For example, if a payment is made to a Working Holiday Maker, information about the host or home country is required. BusinessCraft provides the complete ATO defined list to select from.

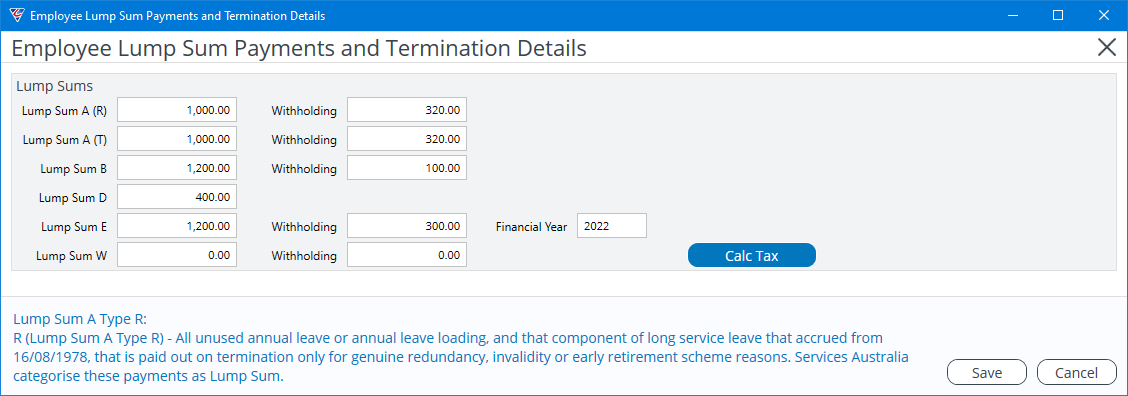

Lump Sums

STP Phase 2 includes changes on how lump sum payments are to be categorised. These changes include:

Lump Sum E – If a Lump Sum E payment is made, the amount for each financial year relevant to the Lump Sum E amount paid must now be included in the STP Phase 2 report before finalising the employee’s records. A separate Manual Payment Entry will be required in BusinessCraft for each Payment Year for Lump Sum E payments for an employee.

Lump Sum W – Return to work payments, which are paid to induce a person to resume work (for example, to end industrial action or to leave another employer) were previously included in gross. In STP Phase 2 reporting, these amounts will need to be reported separately as Lump Sum W.

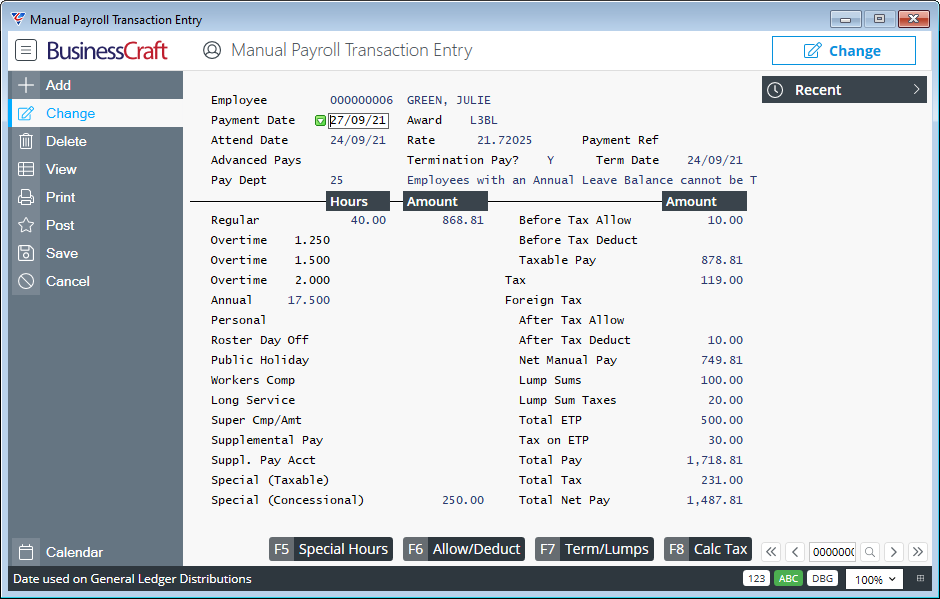

BusinessCraft has significantly redesigned the Manual Payment Entry screen to cater for the additional requirements for Lump Sums in STP Phase 2 as well as the previously described requirements to use Special Hours Codes for the various Paid Leave scenarios.

The Special Hours (F5) button opens the Special Hours Lines screen to cater for the requirement to record multiple Paid Leave entries within the one Manual Payment Entry. The Special (Taxable) and Special (Concessional) fields are populated on the main screen based on whether tax is to be calculated normally or has been manually entered.

The Allow/Deduct (F6) button opens the existing Allowances and Deductions screen with no change to the functionality in that screen.

The Term/Lumps (F7) button opens the Employee Lump Sum Payments and Termination Details screen containing significant functionality changes.

The Calc Tax (F8) button provides the option to calculate Tax for the values on the screen (excluding those where tax has already been manually entered due to a concessional taxation method applicable.

If the Termination Pay field is set to N, then only the Lump Sum Panel is displayed when the Term/Lumps (F7) button is used:

If the Termination Pay field is set to Y, the Termination Date field must be populated and then the Lump Sum Panel, Cessation Type, Leave Accruals and Employment Termination Payment panels are displayed:

A Calc Tax button provides the option to calculate tax (where possible) for the lump sums.

PAYG Tax can be entered manually for Leave Accruals where concessional rates apply. Alternatively leave blank and the Calc Tax (F8) button on the main screen can be used to calculate tax using standard Tax Scales.

ETP Total Tax Withheld cannot be calculated automatically and must be entered.

Reporting Previous Business Management Software IDs and Payroll IDs

The STP Phase 2 option to provide the ATO with previous Business Management Software IDs and Payroll IDs has been included in BusinessCraft. The need for this option may arise due to a change of business structure or when changing STP software, and it is not practical or possible to zero out or finalise the records in the previous system.

This option helps to reduce duplicate income statements occurring for employees in ATO online services.

BusinessCraft provides the ability to record a Previous Business Management Software ID when carrying out a Payroll Update Event. When the Previous Business Management Software ID is used in an Update Event, BusinessCraft will check for a Previous ID in the Employee Master File record for each employee included in the Update Event.

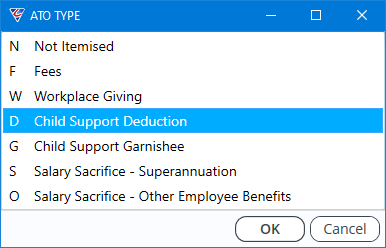

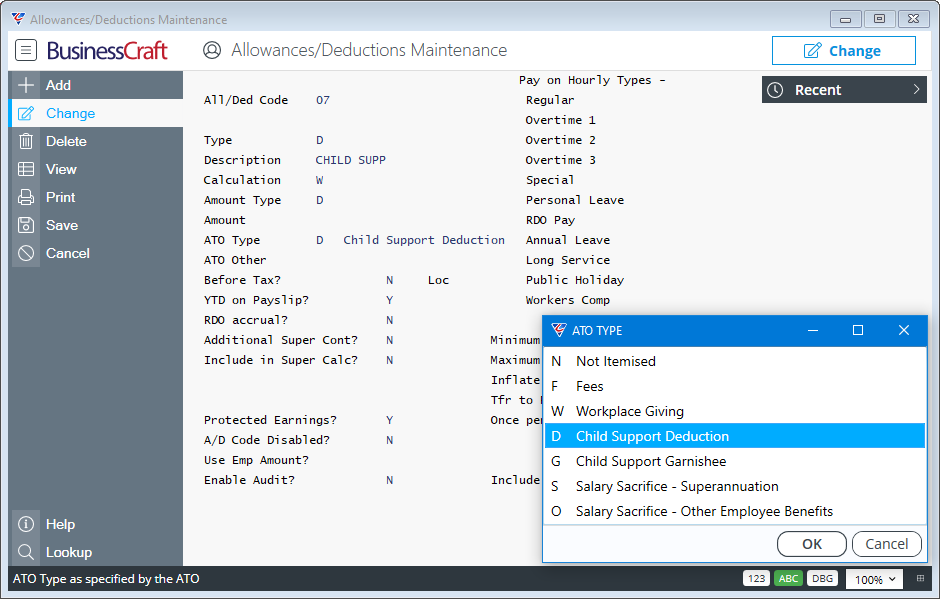

Child Support Garnishees and Child Support Deductions

The option to include Child Support Garnishees and Child Support Deductions in STP Phase 2 is provided. This reduces the need to give separate remittance advices to the Child Support Registrar.

When recording a Child Support Deduction in BusinessCraft with STP Phase 2, two ATO Types can be chosen:

Child Support Deduction – amounts for a notice under Section 45 of the act

Child Support Garnishee – amounts for a notice under Section 72A of the act

Please ensure the Protected Earnings field is set correctly for the Deduction and that the correct Protected Earnings Values announced in January each year are updated in the Payroll Setup screen.

Steps to Transition to STP Phase 2

Instal Required Product Update

Please arrange for the Product Update advised to be installed in accordance with the BusinessCraft Product Update Guide.

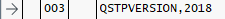

A BusinessCraft Registry setting controls whether the dataset is using STP or STP Phase 2. For BusinessCraft Versions prior to V5.13, the Registry setting is set to use STP.

For this reason, when using a version prior to V5.13, the first step required is to change the Registry setting to make STP Phase 2 available. If installing V5.13 and STP Phase 2 is not to be used, the setting must be changed back. The setting is contained within Environment Extended as follows:

STP STP Phase 2

The year numbers represent the ATO reference years for STP.

Review Allowances

As covered in the key changes section of this document, STP Phase 2 requires all Allowances to be itemised in STP Reporting. No longer is there an option to include any allowances in Gross.

Before processing the first STP Phase 2 payroll, go to Payroll > Tables > Allowances/Deductions and ensure that the ATO Type is correct for each active Allowance:

With the cursor positioned on the ATO Type field optionally click Help in the Menu Sidebar for guidance on the use and purpose of each ATO Type and/or refer to the ATO Web Site to ensure the latest information is being checked.

When Other (OD) is selected for ATO Type, the ATO Other field prompts for a Description. Please check the Help on the ATO Other field as the ATO Other Description must comply with ATO Coding requirements.

The Non-Payroll option provides the ability to record an Allowance for display purposes (primarily on pay slips) to indicate an amount contributed for the employee to a 3rd Party that will not be included in the employee’s pay or reported as income in STP Reporting.

Review Deductions

As covered in the key changes section of this document, STP Phase 2 has made changes to the reporting requirements for certain deductions in STP Reporting. The changes relate specifically to Salary Sacrifice and Child Support, however it is recommended that all active deductions are reviewed.

Before processing the first STP Phase 2 payroll, go to Payroll > Tables > Allowances/Deductions and ensure that the ATO Type is correct for each active Deduction with a specific focus on Salary Sacrifice and Child Support deductions:

Two categories are available for Child Support (Deduction and Garnishee) and for Salary Sacrifice (Superannuation and Other Employee Benefits) that are governed by legislation as explained earlier in this document.

With the cursor positioned on the ATO Type field optionally click Help in the Menu Sidebar for guidance on the use and purpose of each ATO Type and/or refer to the ATO Web Site to ensure the latest information is being checked.

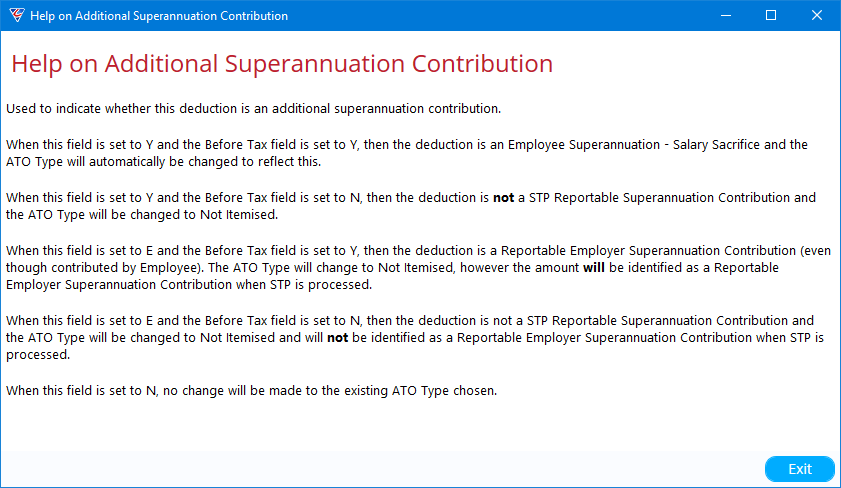

The ATO Type may change from Salary Sacrifice depending on the Before Tax and Additional Super Contribution field settings. Please refer to the Help provided on the Additional Superannuation Contribution field to understand why the ATO Type field changes and the impact on STP submissions.

Review Special Hours Codes

As covered in the key changes section of this document, STP Phase 2 has made significant changes to the reporting requirements for a range of earnings sources that either traditionally required the use of Special Hours Codes or will now require Special Hours Codes. These include Bonuses and Commissions, Directors Fees, Task Payments, Leave Payments and Time Off in Lieu payments (TOIL).

BusinessCraft has added two new fields to address the requirements – Special Hours Code Type and Suppress Hours. The Special Hours Code Type will default to blank (Ordinary Time Earnings). In most cases this will need to be changed to one of the ATO designated options.

The Suppress Hours field is provided for Special Hours Codes that are best suited to be recorded with keyed in Amounts rather than keying Hours with a Rate then applied. Set to Y for Amount based Special Hours Codes (e.g., Directors Fees).

Existing Special Hours Codes

Before processing the first STP Phase 2 payroll, go to Payroll > Tables > Special Hours Codes and ensure that the Special Type is correct for each existing Special Hours Code:

With the cursor positioned on the Special Hours Code Type field optionally click Help in the Menu Sidebar for guidance on the use and purpose of each Special Hours Code Type and/or refer to the ATO Web Site.

Create Special Hours Codes

Before processing the first STP Phase 2 payroll and with reference to the Disaggregation of Gross section of this document, go to Payroll > Tables > Special Hours Codes and create any new Special Hours Codes required ensuring that the Special Hours Code Type selected is correct.

Examples of new Special Hours Codes that may be required that were previously paid as part of Gross are:

Bonuses and Commissions

Directors Fees

Cash out of Leave

Time off in Lieu (Cashed Out or Taken)

Paid Leave on Termination

Review Employee Master File

As covered in the key changes section of this document, STP Phase 2 has made significant changes to the reporting requirements to eliminate the need for Tax File Number Declarations to be sent to the ATO. This has necessitated significant changes to the Employee Master screen:

ATO/Tax Details

Go to Payroll > Maintain > Employees and for each active employee use the ATO/Tax (F6) button to open the ATO /Tax Details screen and ensure that the required fields are completed properly:

Use the lookup to ensure the following fields contain a valid option:

Tax Category

Tax Option

Income Stream

Country (only if required)

Tax Scale (should be correct, but important to check)

ABN – record ABN for Contractors

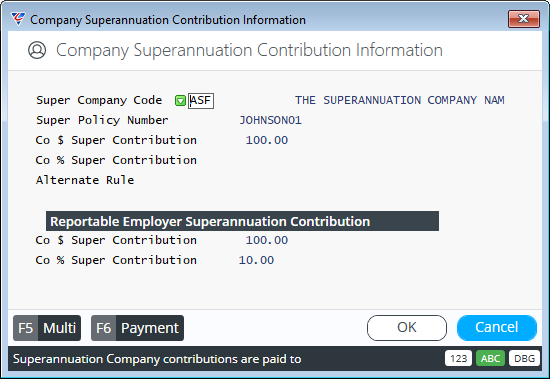

Superannuation

Go to Payroll > Maintain > Employees and for each active employee where the Superannuation field is set to Y, press enter to open the Company Superannuation Contribution Information screen:

Record any Reportable Employer Superannuation Contributions (RESC) for the employee and ensure that any method previously used (e.g., Allowances) is removed for the employee.

Go to Payroll > Tables > Allowances/Deductions and thoroughly review the settings for any Superannuation related Allowance or Deduction to ensure the settings are correct.

With the introduction of the RESC capabilities in the Employee Master, it is unlikely that there should be any active Superannuation related allowances remaining.

For Superannuation related deductions, please ensure the ATO Type and Before Tax fields are set correctly. Pay particular attention to the Additional Superannuation Contribution field with reference to the field help:

Send a Payroll Update Event to the ATO

On completion of these steps, Single Touch Payroll Phase 2 processing can commence.

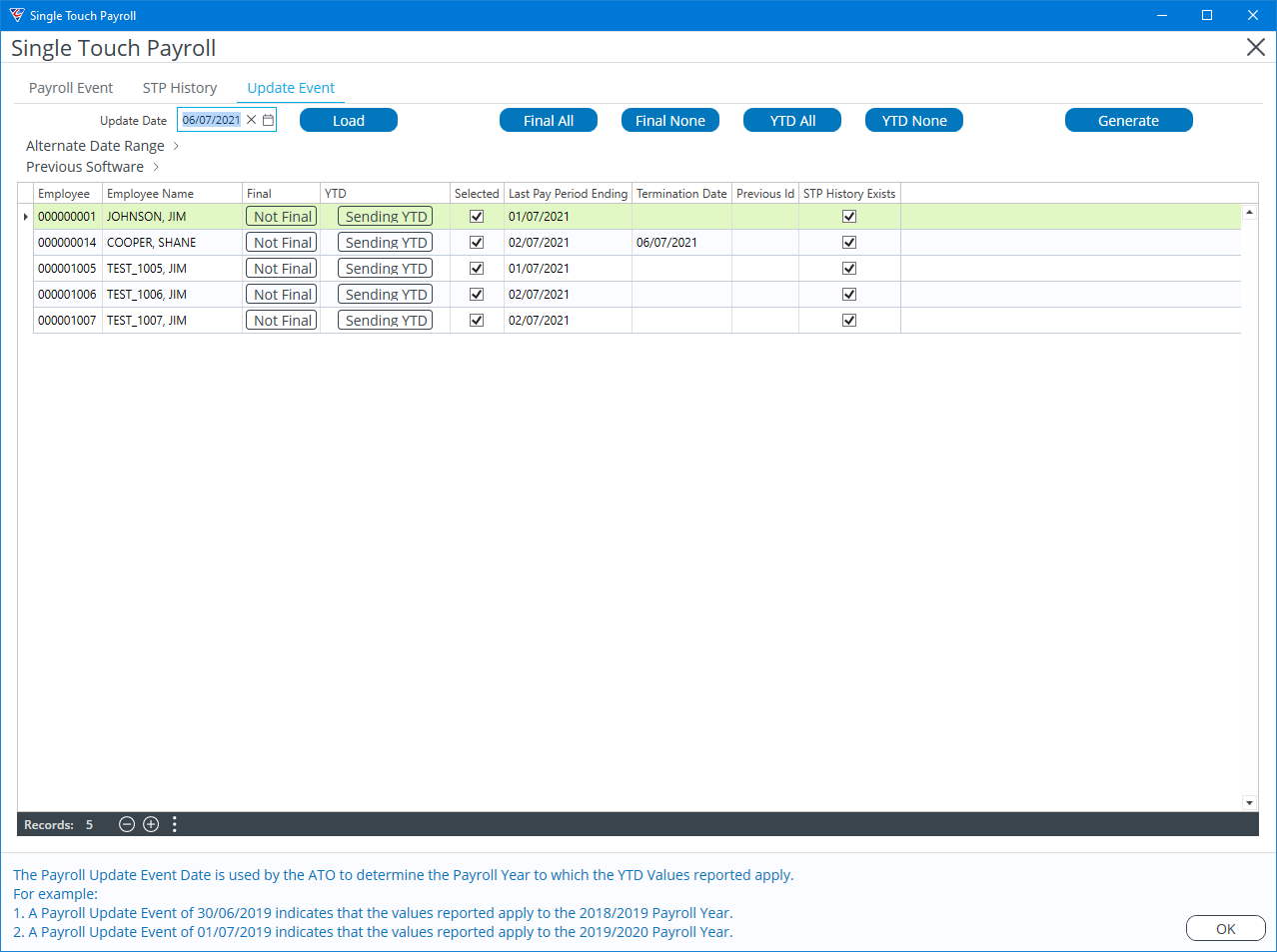

Unless transition to STP Phase 2 is being done from the first pay in a new Payroll Year, it is essential to send an Update Event for all employees to the ATO prior to producing a payroll for the first pay to be processed using STP Phase 2.

Pay particular attention to use the correct Update Date – when positioned on the field, help is provided at the bottom of the screen. The Update Date is the Cut-Off Date for the data that will be provided and will determine the Payroll Year in which the data will be included by the ATO.

Use the YTD All button and do not use the Final All button:

This will ensure the ATO has the current YTD data for all employees in the STP Phase 2 format.

Check the Update Event is successfully submitted and accepted by the ATO, before proceeding to commence Payroll Processing (specifically Produce Payroll) for the first STP Phase 2 Payroll Event.

The Payroll Guides will contain updated details as soon as possible on all impacted screens and processing steps including Employee Master, Allowance/Deductions, Special Hours Codes, Single Touch Payroll and Manual Payment Entry screens.

Revision 1

28/09/2021

Transition to STP Phase 2 Checklist

| Install Required Product Update |

Install the required BusinessCraft Product Update advised by BusinessCraft that provides STP Phase 2 functionality. Check the BusinessCraft STP Registry Setting is set correctly. |

| Review Allowances |

Review all existing active Allowances, in particular:

|

| Review Deductions |

Review all existing active Deductions, in particular checking:

|

| Review existing Special Hours Codes |

Review all existing active Special Hours Codes in particular checking:

|

| Create required Special Hours Codes |

Create any required new Special Hours Codes required for STP Phase 2. For example:

|

| Review Employee Master File |

Check the Employee Master with particular attention to:

|

| User Email Addresses | Payroll user logins in BusinessCraft must have a valid email address. |

| Send a Payroll Update Event to the ATO |

Send a Payroll Update Event for all current employees using an Update Date that will include the last STP Phase 1 Submission YTD values provided that:

|