Setup and Process JobKeeper and JobMaker

Overview

The Federal Government has introduced a $130 billion JobKeeper Payment scheme to support businesses significantly affected by the coronavirus to help keep more Australians in jobs. In summary:

The JobKeeper payment is open to eligible employers to enable them to pay their eligible employee’s salary or wages of at least $1,500 (before tax) per fortnight.

Eligible employers will be reimbursed a fixed amount of $1,500 per fortnight for each eligible employee.

Employers will need to pay eligible employees a minimum of $1,500 (before tax) per fortnight to claim the JobKeeper payment. This will be paid to the employer in arrears each month by the ATO. The first payments to eligible employers will commence in the first week of May 2020. JobKeeper payments can be made for the period beginning 30 March 2020.

If employers do not continue to pay their employees for each pay period, they will cease to qualify for the JobKeeper payment.

To be eligible for the JobKeeper payment, employers and their employees must meet a range of criteria.

This document has been updated to explain required processing changes for JobKeeper 2.0 effective 28th September 2020. Please review this document completely to understand the changes in processing required.

Full details including updates and changes are available from the ATO JobKeeper website.

BusinessCraft can advise on how to configure and process JobKeeper requirement within our STP enabled software but not on the interpretation of JobKeeper legislation.

Setup

Setting up JobKeeper Employee Start Notifications

After following the instructions provided by the ATO to enrol in the JobKeeper scheme, customers using Single Touch Payroll must send a JobKeeper Start Notification to the ATO for all JobKeeper eligible employees on or before 30th April as part of a Single Touch Payroll Event.

The ATO has advised that JobKeeper Start Notifications submitted via Single Touch Payroll must be done using an Allowance Code with very specific settings that must be observed.

Typically, all employees will be eligible from the first JobKeeper fortnight which will require the setup of one Allowance Code. However, there may be exceptional circumstances where an employee becomes eligible from a subsequent fortnight, and this will require an additional Allowance Code for that fortnight number.

With the introduction of JobKeeper 2.0, there is no need to submit a Start Notification for employees already covered by Job Keeper. However, there is a requirement to submit a start notification for employees previously not eligible for JobKeeper, who become eligible for JobKeeper 2.0. Please note there is a change by the ATO to the Short Description to be used.

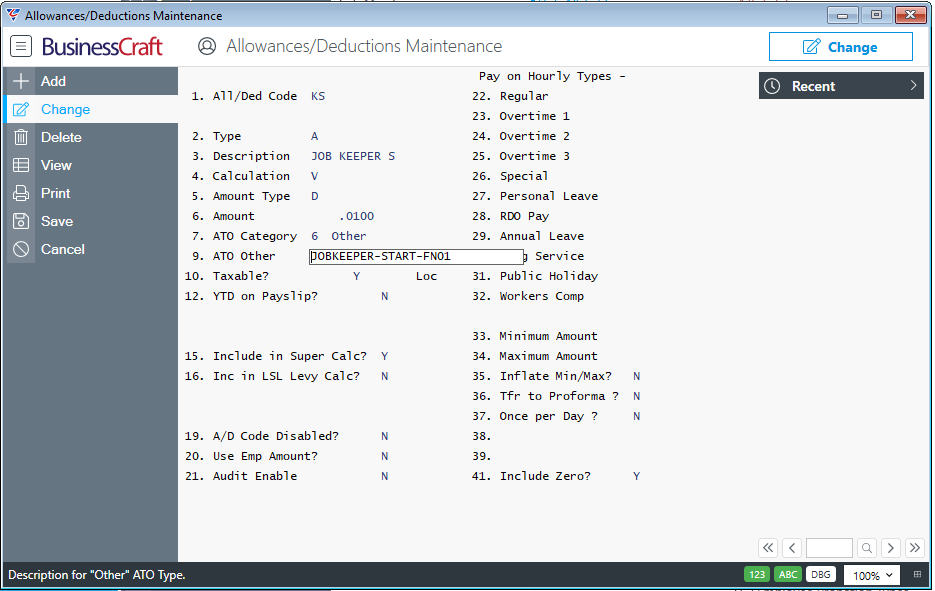

Go to Payroll > Tables > Allowances/Deductions and the Allowances/Deductions Maintenance screen will be displayed. Click Add to create a new record.

Here is an example of a JobKeeper Start Notification set up as required by the ATO for fortnight 1 – the table below will explain the critical fields that must be setup correctly to satisfy ATO requirements:

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

Enter .0100 (This represents 1 cent) The ATO originally preferred a zero value but recognised that this could cause unnecessary disruption to all approved payroll software suppliers and their customers and has since allowed a minimal amount to be entered instead of zero. |

| ATO Category |

This is a critical requirement from the ATO. Select/enter 6 (Other) |

| ATO Other |

This is a critical requirement from the ATO. Enter JOBKEEPER-START-FN with the Fortnight Start Number appended for this Allowance Code. In this example, we have used JOBKEEPER-START-FN01 as this Allowance Code when used for eligible employees will indicate that they are eligible for JobKeeper from fortnight 1. If you encounter an exceptional circumstance where an eligible employee becomes eligible after fortnight 1, you will need to create another allowance code with the ATO Other indicating that fortnight. For example, for an employee who becomes eligible in fortnight 3 this field will be entered as JOBKEEPER-START-FN03 For employees previously ineligible for JobKeeper, who become eligible for JobKeeper 2.0, the code to be used has been shortened to JK-ST-FNXX where XX refers to the fortnightly period on or after 28th September when the employee became eligible for Job Keeper 2.0. Please note that a Payment Tier notification will also be required. |

| Taxable/Before Tax |

Enter Y to indicate the Allowance is Taxable. It is not expected that this will make any significant difference to the employee’s take home pay. |

| Loc |

Leave blank. |

| YTD on Payslip |

Enter N to indicate the YTD for this Allowance is not required to be shown on the payslip. |

| Include in Super Calc |

Enter Y to include the Allowance in Superannuation Guarantee calculations or N to exclude it from those calculations. It is not expected that this will make any significant difference to the employee’s superannuation contribution. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the Payroll Event including the Start Notification has been successfully submitted to the ATO. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

Setting up JobKeeper Employee Finish Notifications

Where JobKeeper processing has commenced for an employee and that employee is terminated, the ATO require a JobKeeper Employee Finish Notification to be provided. This will require Allowance Codes to be created for each fortnight in which employees are terminated and processed for those employees as part of their termination payments through Single Touch Payroll.

With the introduction of JobKeeper 2.0, there is no need to submit a Finish Notification for employees covered by Job Keeper but ineligible for JobKeeper 2.0. If a Payment Tier notification is not submitted for those employees, it is assumed that they are no longer eligible for JobKeeper. Please note there is a change by the ATO to the Short Description to be used.

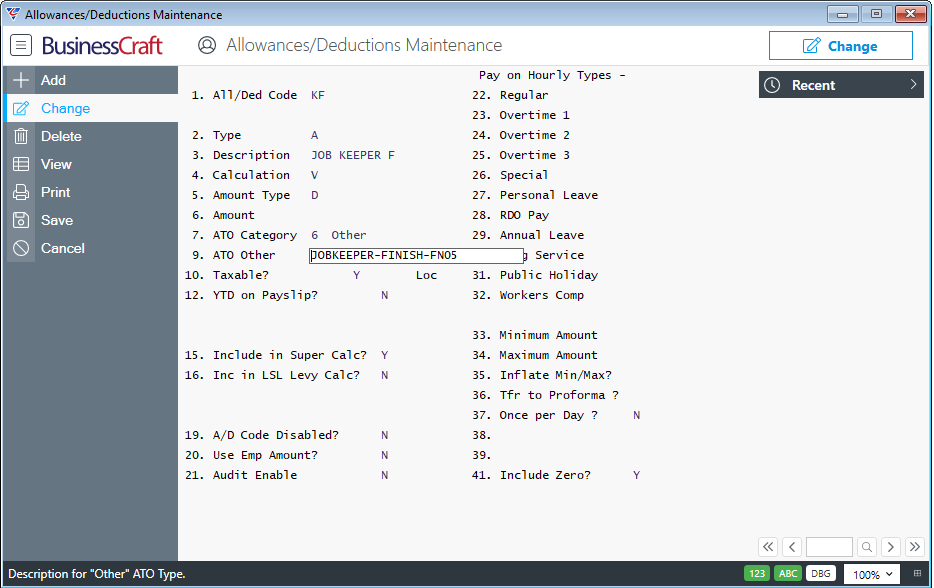

Go to Payroll > Tables > Allowances/Deductions and the Allowances/Deductions Maintenance screen will be displayed. Click Add to create a new record.

Here is an example of a JobKeeper Finish Notification set up as required by the ATO for fortnight 5 – the table below will explain the critical fields that must be setup correctly to satisfy ATO requirements:

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

Enter .0100 (This represents 1 cent) The ATO originally preferred a zero value but recognised that this could cause unnecessary disruption and has since allowed a minimal amount to be entered instead of zero. |

| ATO Category |

This is a critical requirement from the ATO. Select/enter 6 (Other) |

| ATO Other |

This is a critical requirement from the ATO. Enter JOBKEEPER-FINISH-FN with the Fortnight Finish Number appended for this Allowance Code. In this example, we have used JOBKEEPER-FINISH-FN05 as an example of a code setup for employees terminated in fortnight 5. You only need to set up these codes for fortnights when employees are terminated as and when the occur. For JobKeeper 2.0, the code to be used has been shortened to JK-FI-FNXX where XX refers to the fortnightly period on or after 28th September when the employee ceased to be eligible for Job Keeper 2.0. |

| Taxable/Before Tax |

Enter Y to indicate the Allowance is Taxable. It is not expected that this will make any significant difference to the employee’s take home pay. |

| Loc | Leave blank. |

| YTD on Payslip | Enter N to indicate the YTD for this Allowance is not required to be shown on the payslip. |

| Include in Super Calc |

Enter Y to include the Allowance in Superannuation Guarantee calculations or N to exclude it from those calculations. It is not expected that this will make any significant difference to the employee’s superannuation contribution. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the Payroll Event using the Finish Notification has been successfully submitted to the ATO. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

Setting up a JobKeeper Top Up Allowance Code

Qualifying employers who claim the JobKeeper payment for each qualifying employee must pay the full amount of the allowance of $1,500 per fortnight to the employee, before tax is withheld. Where an employee earns less than this amount, a Top Up payment must be paid by the employer for the difference.

Based on varying pay frequencies and Top Up situations, it is highly recommended that the ATO JobKeeper website is used as a reference point. BusinessCraft can advise on how to configure and process but not on the interpretation of JobKeeper legislation.

Top Up payments require at least one Allowance Code to be created but more can optionally be created depending on how many employees are affected and if there is consistency in the Top Up amounts or not.

For example, if Top Up employees are all paid the same amount (e.g., 1st Year Apprentices) and with no overtime etc., then a Top Up Allowance Code could be setup for 1st Year Apprentices. In that case the Amount field can contain the Top Up amount for the pay cycle (e.g., Week, Fortnight, Month)

In many cases, the Top Up amount will not be known until the second weeks payrun is calculated (Weekly Payrolls) or the payrun is calculated (Fortnightly and Monthly Payrolls). In this case, it is recommended to create a Top Up Code with an Amount of $1.00 and record the required Top Up amount during Payroll Entry for each impacted employee.

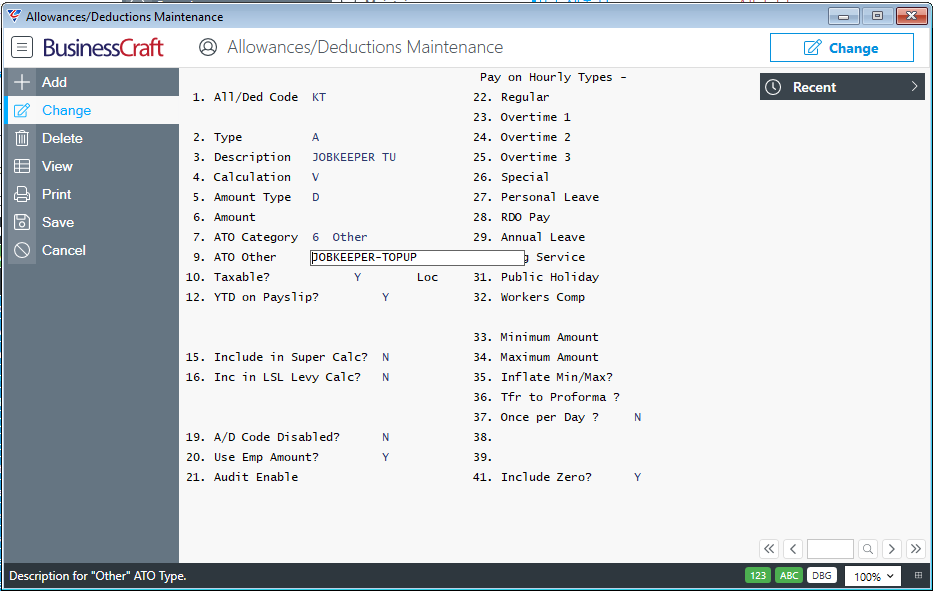

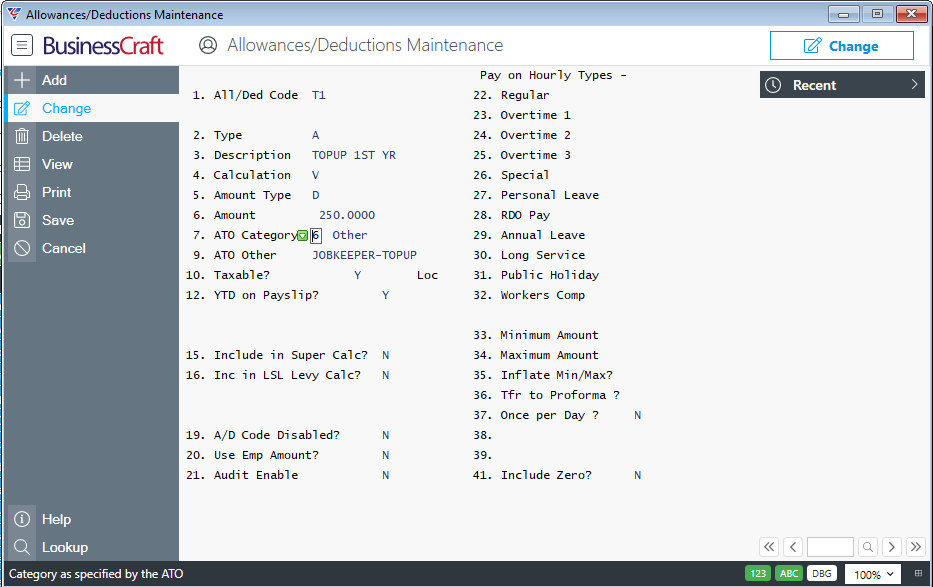

Go to Payroll > Tables > Allowances/Deductions and the Allowances/Deductions Maintenance screen will be displayed. Click Add to create a new record.

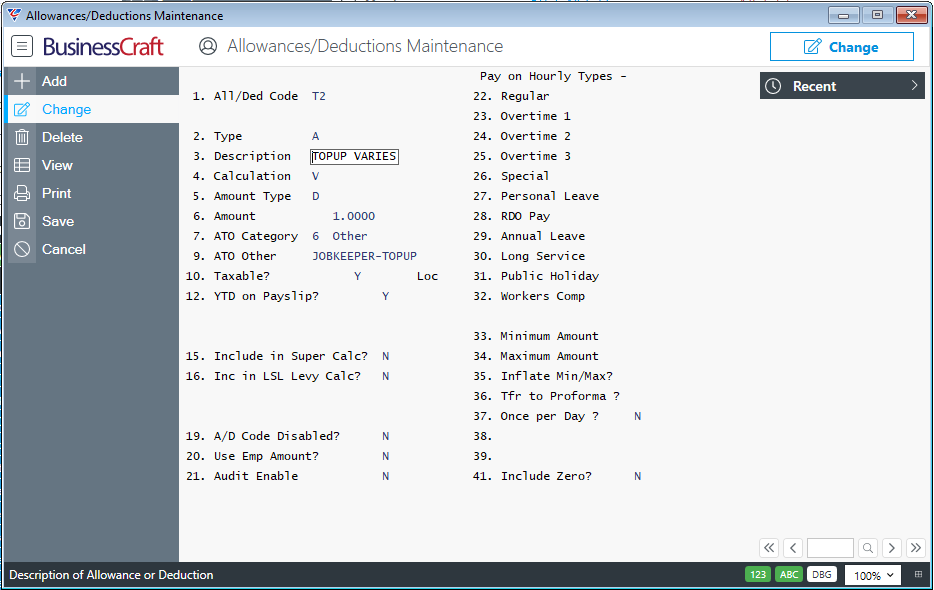

Here is an example of a JobKeeper Top Up Allowance Code set up as required by the ATO – the table below will explain the critical fields that must be setup correctly to satisfy ATO requirements. (Please note there is a change by the ATO to the Short Description to be used)

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

If the Top Up Amount is always going to be the same for employees linked to this code enter the Top Up amount for the pay cycle. If the Top Up amount cannot be predicted with certainty, then enter $1.00 and this will need to be changed for each employee during Payroll Entry. |

| ATO Category |

This is a critical requirement from the ATO. Select/enter 6 (Other) |

| ATO Other |

This is a critical requirement from the ATO. Enter JOBKEEPER-TOPUP. For JobKeeper 2.0, the code to be used has been shortened to JK-TOPUP. |

| Taxable/Before Tax |

Enter Y to indicate the Allowance is Taxable. |

| Loc |

Leave blank. |

| YTD on Payslip |

Enter Y to indicate the YTD for this Allowance is required to be shown on the payslip (Payslip Template will need to be updated) or N to suppress the YTD for this allowance from the payslip. |

| Include in Super Calc |

Enter Y to include the Allowance in Superannuation Guarantee calculations or N to exclude it from those calculations. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the conclusion of the Job Keeper scheme. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

Setting up JobKeeper Employee Payment Tiers

Effective the fortnight commencing 28 September 2020, JobKeeper conditions and payment rates change, requiring employers to classify eligible employees into Payment Tiers 1 or 2. This determines the amount of money paid to employers. Full details can be found on the ATO Web Site or by obtaining advice from your financial advisor.

This change necessitates the creation of two additional Allowance Codes (one for each Tier). Each eligible employee must have a Payment Tier Allowance Code recorded in the first possible STP submission to the ATO on or after 28th September 2020.

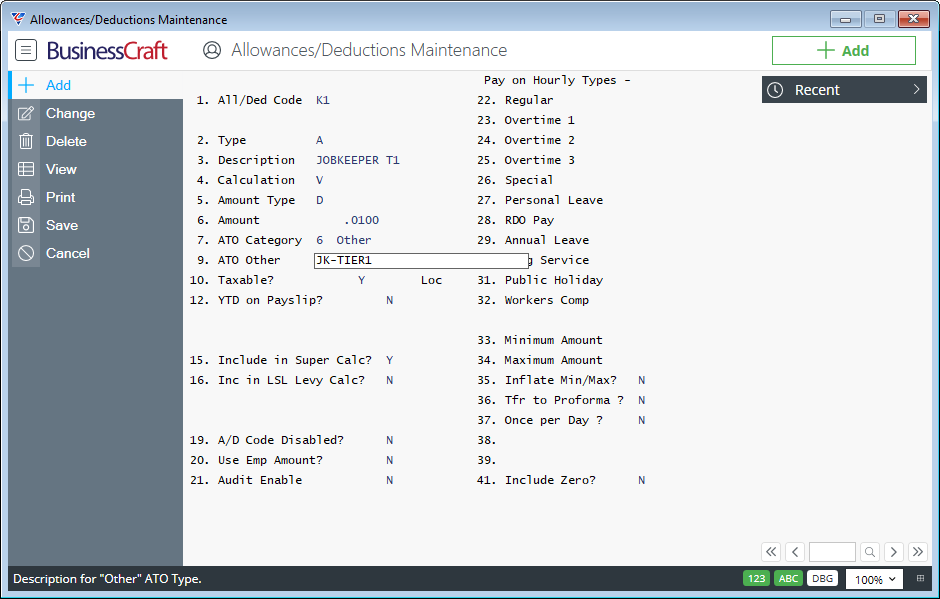

Go to Payroll > Tables > Allowances/Deductions and the Allowances/Deductions Maintenance screen will be displayed. Click Add to create a new record.

Here is an example of a JobKeeper Payment Tier 1 code set up as required by the ATO – the table below will explain the critical fields that must be setup correctly to satisfy ATO requirements:

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

Enter .0100 (This represents 1 cent) The ATO originally preferred a zero value but recognised that this could cause unnecessary disruption and has since allowed a minimal amount to be entered instead of zero. |

| ATO Category |

This is a critical requirement from the ATO. Select/enter 6 (Other) |

| ATO Other |

This is a critical requirement from the ATO. Enter JK-TIER1 or JK-TIER2 depending on which Payment Tier Notification Code being set up In this example, we have used JK-TIER1 for employees eligible for JobKeeper 2.0 Payment Tier 1. |

| Taxable/Before Tax | Enter Y to indicate the Allowance is Taxable. |

| Loc | Leave blank. |

| YTD on Payslip | Enter N to indicate the YTD for this Allowance is not required to be shown on the payslip. |

| Include in Super Calc |

Enter Y to include the Allowance in Superannuation Guarantee calculations or N to exclude it from those calculations. It is not expected that this will make any significant difference to the employee’s superannuation contribution. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the Payroll Event using the Finish Notification has been successfully submitted to the ATO. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

Setting up JobMaker Employee Nomination and Payment Period Codes

The JobMaker scheme requires eligible employees to be nominated as and when they become eligible for the scheme and then payment claims to be submitted for each eligible employee for the claim periods specified in accordance with the deadlines set.

Full details can be found on the ATO Web Site or by obtaining advice from your financial advisor.

To submit JobMaker claims through BusinessCraft using STP, Allowance Codes must be used in a similar manner to JobKeeper. One code is required for employee nominations and additional codes are required for each JobMaker Claim period.

Additional codes are required to cancel an employee nomination or to cancel an incorrect payment claim. Details of the coding system to be used is contained on the ATO Web site.

Go to Payroll > Tables > Allowances/Deductions and the Allowances/Deductions Maintenance screen will be displayed. Click Add to create a new record.

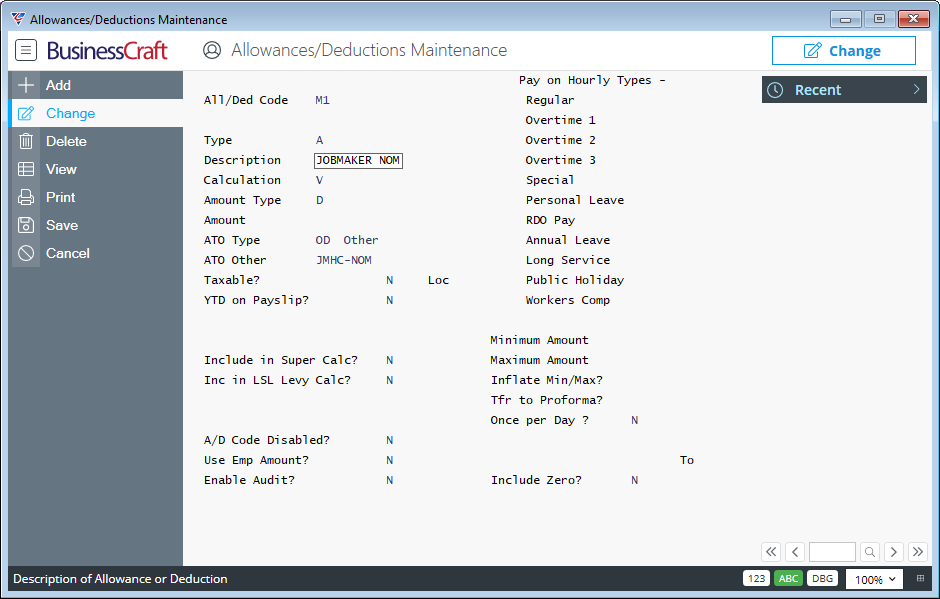

Here is an example of a JobMaker Nomination code set up as required by the ATO – the table below will explain the critical fields that must be setup correctly to satisfy ATO requirements:

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction nor does the code need to be M1 as shown in this example. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

Enter 0 |

| ATO Category |

This is a critical requirement from the ATO. For STP, select/enter 6 (Other) for STP Phase 2 select OD |

| ATO Other |

This is a critical requirement from the ATO. Enter JMHC-NOM |

| Taxable/Before Tax | Enter N to indicate the Allowance is Taxable. |

| Loc | Leave blank. |

| YTD on Payslip | Enter N to indicate the YTD for this Allowance is not required to be shown on the payslip. |

| Include in Super Calc | Enter N to exclude the allowance from those calculations. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the JobMaker scheme concludes. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

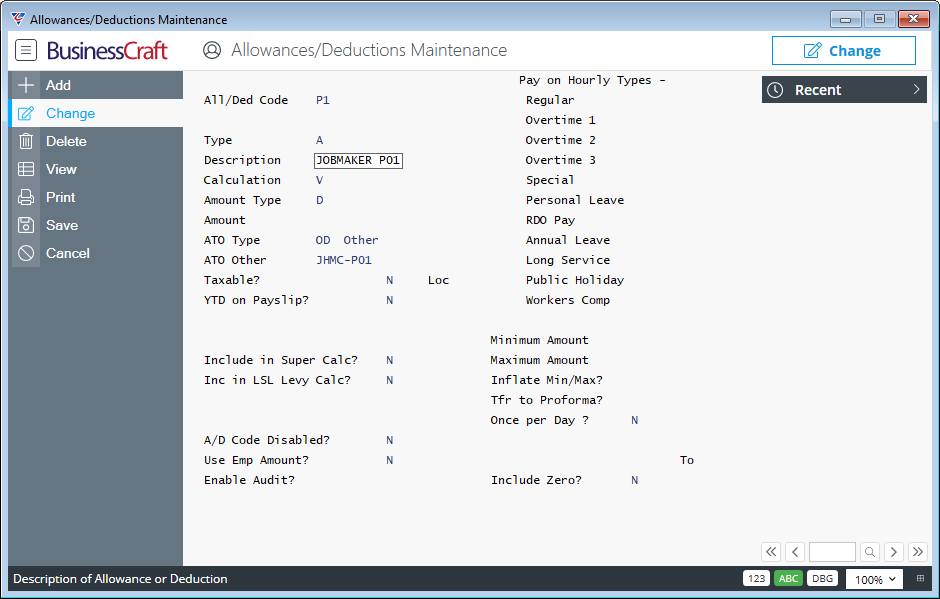

A separate Allowance code is required for each payment period - here is an example:

| All/Ded Code | A user defined 2-character alpha/numeric field used to uniquely identify the Allowance/Deduction Code. It is not necessary to use the code to indicate if the code is for an Allowance or a Deduction nor does the code need to be P1 as shown in this example. |

| Type | Select/enter Allowance (A). |

| Description | A user defined 12-character alpha/numeric field that describes the nature of the Allowance/Deduction Code. |

| Calculation | Select/enter Variable (V). |

| Amount Type | Select/enter Dollar Amount (D). |

| Amount |

Enter 0 |

| ATO Category |

This is a critical requirement from the ATO. For STP, select/enter 6 (Other) for STP Phase 2 select OD |

| ATO Other |

This is a critical requirement from the ATO. Enter JMHC-P01 etc depending on the payment period. |

| Taxable/Before Tax | Enter N to indicate the Allowance is Taxable. |

| Loc | Leave blank. |

| YTD on Payslip | Enter N to indicate the YTD for this Allowance is not required to be shown on the payslip. |

| Include in Super Calc | Enter N to exclude the allowance from those calculations. |

| Include in LSL Calc | Enter N to exclude from Long Service Leave Levy calculations. |

| A/D Code Disabled |

Enter N to ensure the Allowance Code is not disabled. This can be changed to Y after the JobMaker scheme concludes. |

| Use Emp Amount | Enter N to ensure that the Amount already entered on this screen is used for this Allowance Code. |

| Audit Enable | Enter N as this is not necessary for this type of Allowance Code. |

Processing

Processing JobKeeper Start Notifications

As indicated earlier in this document, after following the instructions provided by the ATO to enrol in the JobKeeper scheme, customers using Single Touch Payroll must send a JobKeeper Start Notification to the ATO for all JobKeeper eligible employees on or before 30th April as part of a Single Touch Payroll Event.

For this example, it is assumed that a JobKeeper Start Notification Allowance code has been correctly setup as described earlier in this document.

This example will be using the Labour Job Cost Entry screen; however, the same principles apply to other forms of Payroll Entry in BusinessCraft. Instructions for Payroll Entry are contained in the existing published Payroll Guides. This document is focused on how to process JobKeeper transactions.

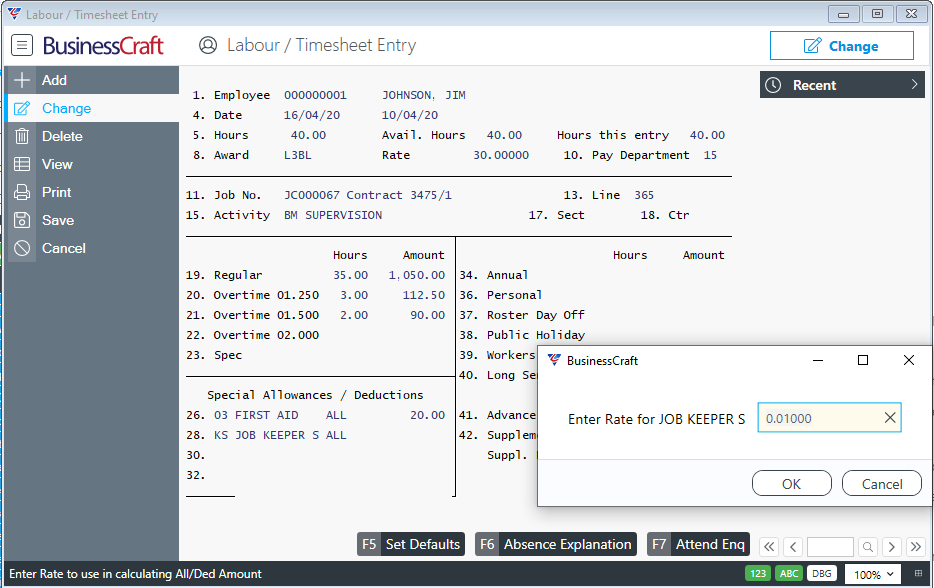

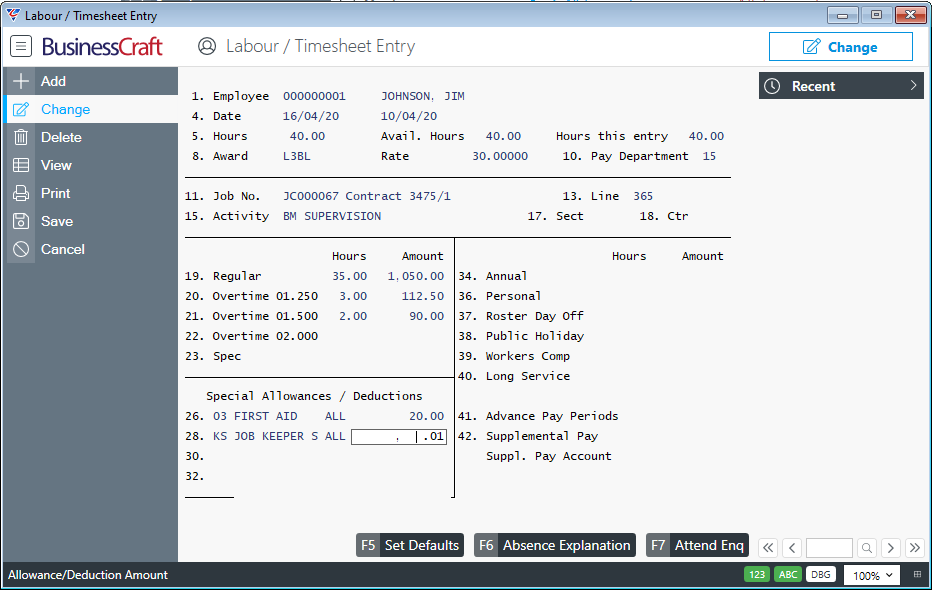

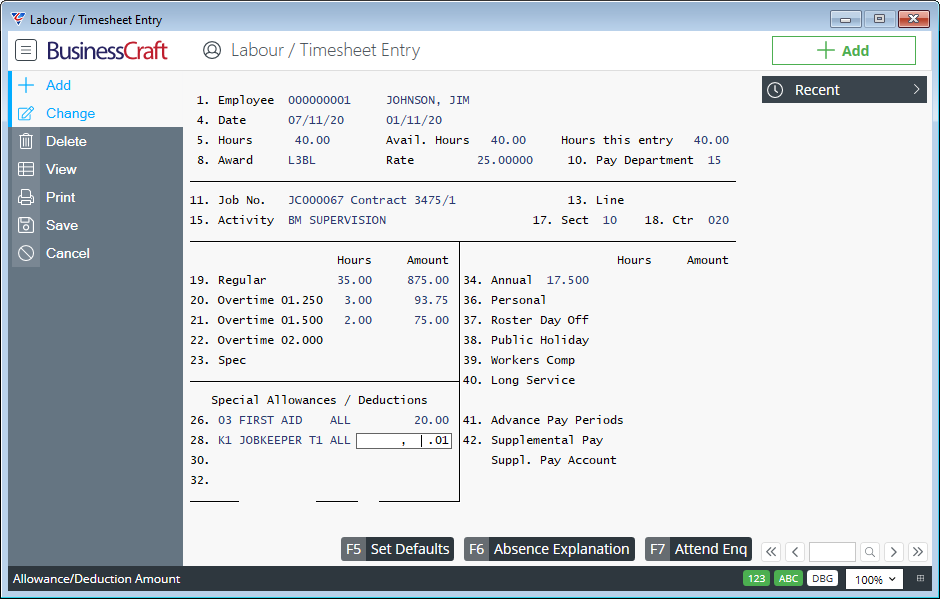

For example, go to Payroll > Transactions >Labour Job Cost Entry and for each eligible employee, enter/select the Allowance Code for JobKeeper Start Notification (in this example fortnight 1):

After entering/selecting the Allowance Code an Enter Rate prompt will be displayed. Accept the default of 0.01000 and click OK.

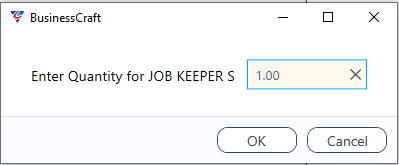

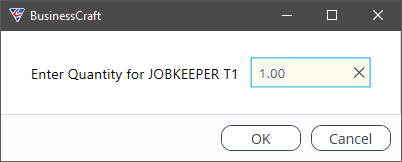

A prompt for Quantity will be displayed:

Again, accept the default and click OK.

An amount of $0.01 will be recorded in the Payroll Entry screen for the employee:

This will ensure that Single Touch Payroll processing will submit a JobKeeper Employee Start Notification to the ATO for the required fortnight number when the Single Touch Payroll File is successfully submitted to the ATO.

The JobKeeper Employee Start Notification is required to be sent once – it is not required to be sent for every payroll during the JobKeeper scheme duration.

If additional employees become eligible for Job Keeper after fortnight 1, then a JobKeeper Employee Start Notification must be processed for those employees using an Allowance Code for the correct start fortnight.

Processing JobKeeper Finish Notifications

Where JobKeeper processing has commenced for an employee and that employee is terminated, the ATO require a JobKeeper Employee Finish Notification to be provided. This will require Allowance Codes to be created for each fortnight in which employees are terminated and processed for those employees as part of their termination payments through Single Touch Payroll.

For this example, it is assumed that a JobKeeper Finish Notification Allowance code has been correctly setup as described earlier in this document for the fortnight in which the employee is being terminated.

This example will be using the Manual Payroll Transaction Entry screen as this screen is most likely the one that will be used for terminations; however, the same principles apply to other forms of Payroll Entry in BusinessCraft.

Instructions for Payroll Entry and specifically Manual Payments are contained in the existing published Payroll Guides. This document is focused on how to process JobKeeper transactions for terminated employees.

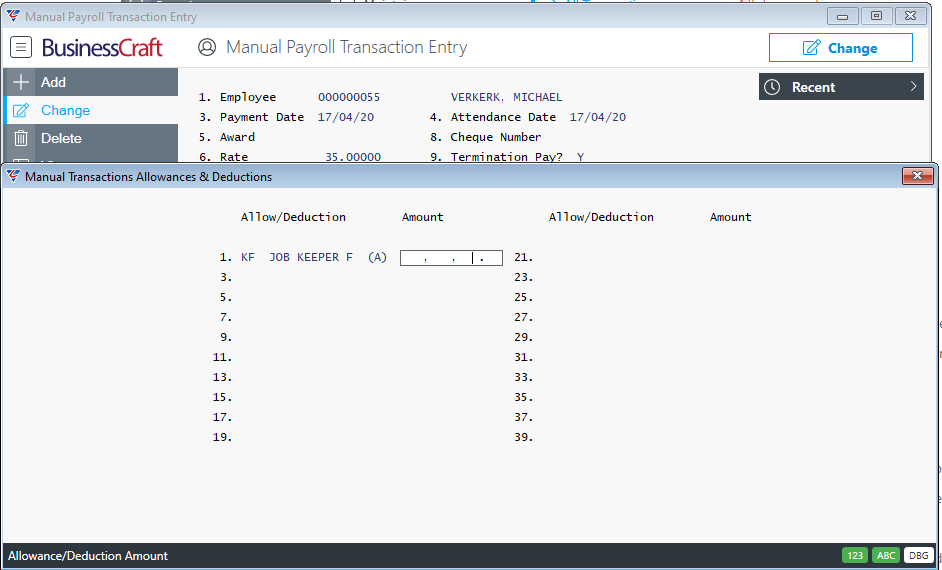

Go to Payroll > Transactions > Manual Payments and enter/select the Employee being terminated.

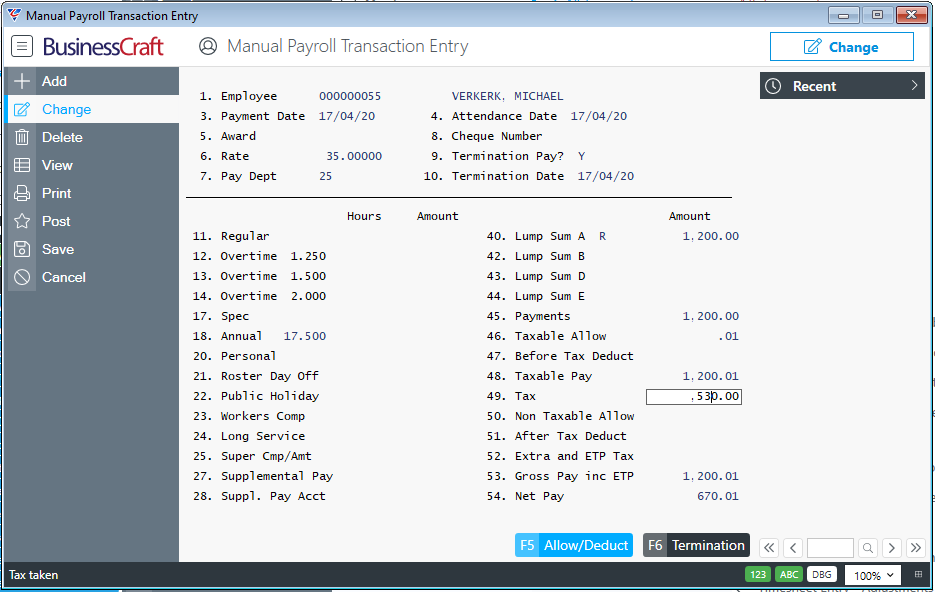

After entering required Termination Payment details including any ETP components, use the Allow/Deduct (F5) function key to open the Manual Transactions Allowances & Deductions screen and enter/select the required Allowance Code for the Finish fortnight:

Please note the Amount of $0.01 does not default – please ensure an amount of $0.01 is entered in the Amount field and then exit from the screen.

Check the Taxable Allowance field contains the $0.01 amount along with any other Taxable Allowances being paid:

Complete the Posting of the Manual Payment followed by the Single Touch Processing requirements.

This will ensure that Single Touch Payroll processing will submit a JobKeeper Employee Finish Notification to the ATO for the required fortnight number when the Single Touch Payroll File is successfully submitted to the ATO.

Processing JobKeeper Top Up Payments

Qualifying employers who claim the JobKeeper payment for each qualifying employee must pay the full amount of the allowance of $1,500 per fortnight to the employee, before tax is withheld. Where an employee earns less than this amount, a Top Up payment must be paid by the employer for the difference.

Based on varying pay frequencies and Top Up situations, it is highly recommended that the ATO JobKeeper website is used as a reference point, particularly with the introduction of JobKeeper 2.0.

BusinessCraft can advise on how to configure and process within our STP enabled software but not on the interpretation of JobKeeper legislation.

Two JobKeeper 1.0 scenarios will be covered to provide an understanding of how to ensure Top Up requirements are addressed adequately. For other scenarios, if it is unclear, create a Service Request in the BusinessCraft Service Portal or email BC Service with full details of the scenario/issue you are trying to resolve.

Example 1- Top Up Employees are paid same amount each pay cycle

If Top Up employees are all paid the same amount (e.g., 1st Year Apprentices) and with no overtime etc., then a Top Up Allowance Code can be setup for 1st Year Apprentices.

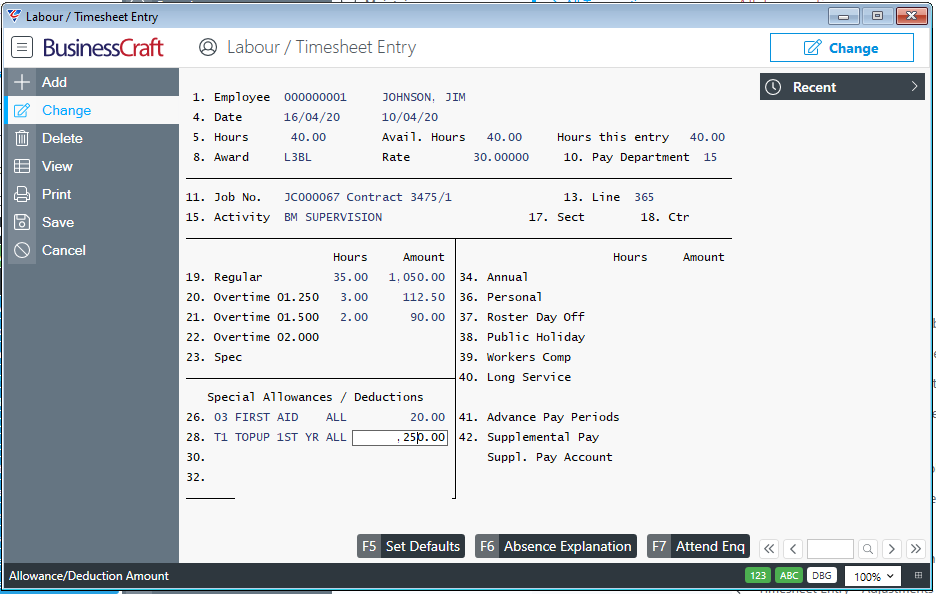

In that case the Amount field can contain the Top Up amount for the pay cycle (e.g., Week, Fortnight, Month) – in this case all employees linked to this Top Up Allowance will receive $250.00 Before Tax in addition to their normal earnings:

After setting up the required Top Up Allowance Code, it can be used in Payroll Entry, whether that is in any of the required screens including Standing Payroll Attendance.

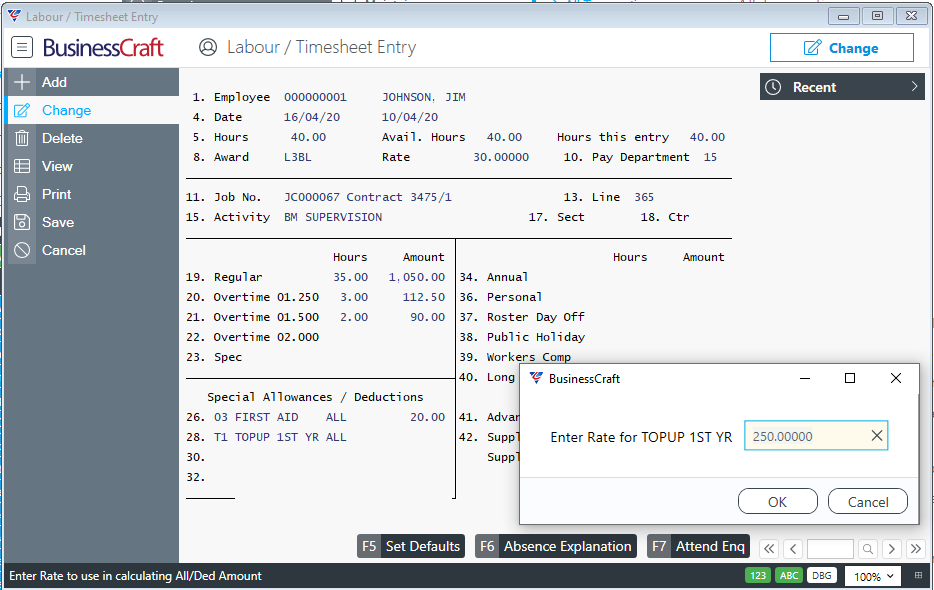

For this example, the Labour Job Cost Entry screen is used:

After entering/selecting the Allowance Code an Enter Rate prompt will be displayed. Accept the default of $250.000000 and click OK.

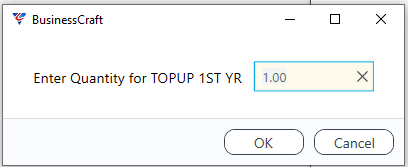

A prompt for Quantity will be displayed:

Accept the default and click OK. An amount of $250.00 will be recorded in the Payroll Entry screen for the employee:

When this entry is processed through single Touch Payroll, the ATO will be notified of the Top Up Amount paid

Example 2 - Top Up Employees are paid different amounts each pay cycle

In other cases, the Top Up amount will not be known until the second weeks payrun is calculated (Weekly Payrolls) or the payrun is calculated (Fortnightly and Monthly Payrolls).

In this case, it is recommended to create a Top Up Code with an Amount of $1.00 and record the required Top Up amount during Payroll Entry for each impacted employee.

After setting up the required Top Up Allowance Code, it can be used in Payroll Entry, whether that is in any of the required screens including Standing Payroll Attendance.

As the amount of the Top Up is not known, it will be necessary to carry out the Calculate Payroll step to determine the Top Up amount:

Every second week of the JobKeeper fortnight for Weekly Pay Cycles

Every fortnight of the JobKeeper fortnight for Fortnightly Pay Cycles

Once a month for Monthly Pay Cycles – please check ATO website for Top Up provisions

After running Calculate Payroll as explained above, the top up amount needs to be determined in accordance with ATO definitions.

Once determined the gross amount required for the Top Up can be added to the required Payroll Transactions before re-calculating the payroll.

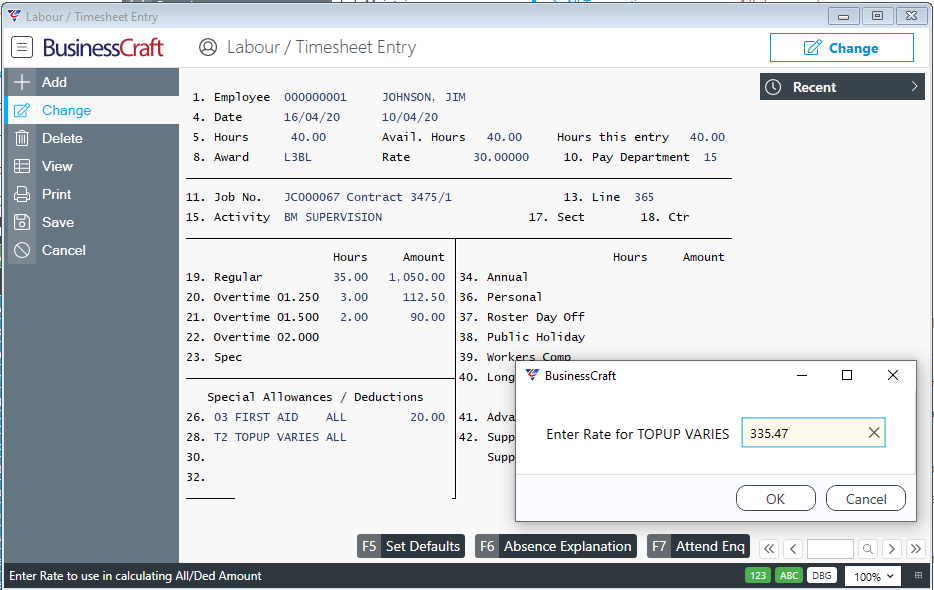

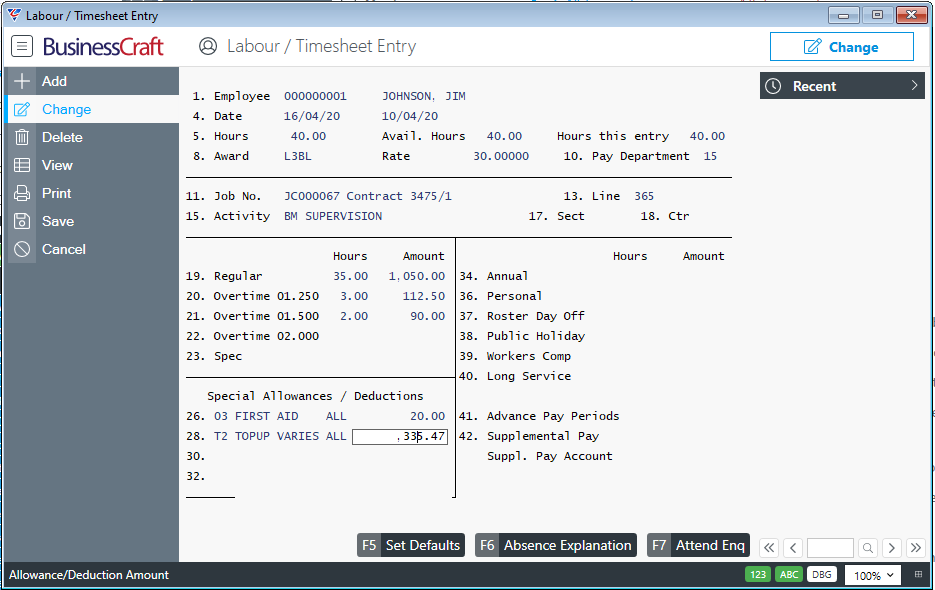

For this example, the Labour Job Cost Entry screen is used:

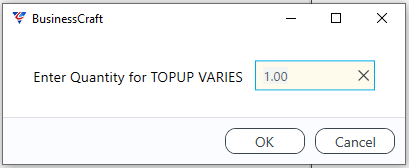

After entering/selecting the Allowance Code an Enter Rate prompt will be displayed. Change the default of 1.00000 to the required Top Up Amount and click OK. A prompt for Quantity will be displayed:

Accept the default and click OK. An amount representing the Top Up amount entered in the rate field will be recorded in the Payroll Entry screen for the employee:

When this entry is processed through Single Touch Payroll, the ATO will be notified of the Top Up Amount paid.

Processing JobKeeper 2.0 Payment Tier Notifications

As indicated earlier in this document, after following the instructions provided by the ATO and setting up Payment Tier Notification Codes in Payroll > Tables > Allowances/Deductions, customers using Single Touch Payroll must send a JobKeeper Payment Tier Notification to the ATO for all JobKeeper 2.0 eligible employees on or after 28th September 2020 as part of a Single Touch Payroll Event.

For this example, it is assumed that a JobKeeper Payment Notification Allowance code for Payment Tier 1 has been correctly setup as described earlier in this document.

This example will be using the Labour Job Cost Entry screen; however, the same principles apply to other forms of Payroll Entry in BusinessCraft. Instructions for Payroll Entry are contained in the existing published Payroll Guides. This document is focused on how to process JobKeeper transactions.

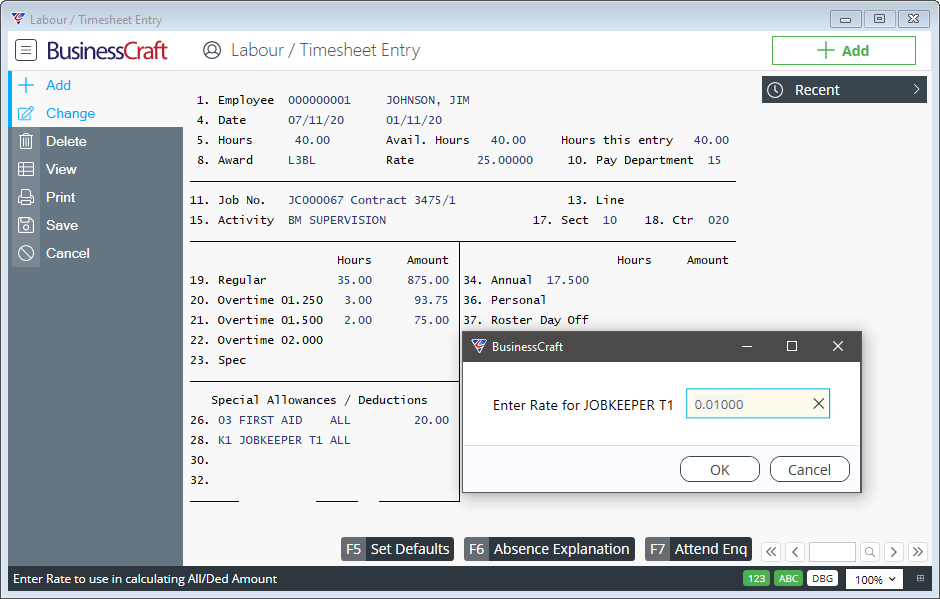

For example, go to Payroll > Transactions > Labour Job Cost Entry and for each Job Keeper 2.0 eligible employee, enter/select the required Payment Tier Notification Allowance Code:

After entering/selecting the Allowance Code an Enter Rate prompt will be displayed. Accept the default of 0.01000 and click OK.

A prompt for Quantity will be displayed:

Accept the default and click OK.

An amount of $0.01 will be recorded in the Payroll Entry screen for the employee:

This will ensure that Single Touch Payroll processing will submit a JobKeeper 2.0 Employee Payment Tier 1 or Tier 2 Notification to the ATO when the Single Touch Payroll File is successfully submitted to the ATO.

The JobKeeper Employee Payment Tier Notification is required to be sent once – it is not required to be sent for every payroll during the JobKeeper scheme duration.

However, if a Payment Tier notification has been sent incorrectly or the employees eligibility changes from one Tier to another Tier, then a subsequent notification is required for that employee.

If additional employees become eligible for Job Keeper 2.0 subsequently, then a JobKeeper Employee Start Notification must be processed for those employees using an Allowance Code for the correct start fortnight as well as a Payment Tier Notification.

Processing JobMaker Employee Nominations and Payment Claims

As indicated earlier in this document, after following the instructions provided by the ATO and setting up Employee Nomination and Payment Claim Codes in Payroll > Tables > Allowances/Deductions, customers using Single Touch Payroll must send a JobMaker Employee Nomination to the ATO for all JobMaker eligible employees as part of a Single Touch Payroll Event.

At the same time or after submitting Employee Nominations, Payment Claims need to be submitted for each relevant Claim Period.

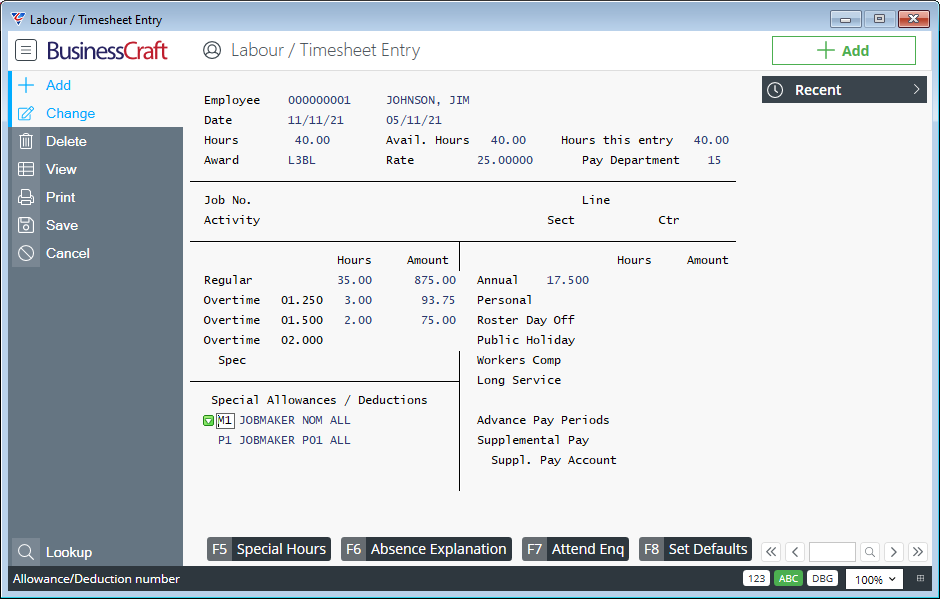

This example will be using the Labour Job Cost Entry screen; however, the same principles apply to other forms of Payroll Entry in BusinessCraft. Instructions for Payroll Entry are contained in the existing published Payroll Guides.

For example, go to Payroll > Transactions > Labour Job Cost Entry and for each JobMaker eligible employee, enter/select the JobMaker Employee Nomination Allowance Code in the Special Allowances/Deductions screen:

Whether employees need to be nominated for each claim period should be confirmed by checking the ATO Website or with your financial advisor.

For each eligible employee, for each claim period, enter/select the appropriate JobMaker Payment Period Allowance Code for the relevant payment period as shown above. This can be done separately from nominations or at the same time.

Revision 3

11th November 2021