Accounts Payable Tables and Setup

Overview

The Accounts Payable module is the source of supplier related information including:

Supplier Master File Information

Amounts owing to Suppliers

Invoice Entry including matching to Purchase Orders where applicable.

Held Invoice Management including Event Based Holds

Payment Processing including Foreign Currency Payments and Landed Costing

Tolerance and Extra to Schedule Controls

Supplier Back Charges

EDI for specified suppliers.

The Accounts Payable module contains a wide range of Enquiries and Reports:

Supplier Information

Ageing Reports

Open Items

History

Distributions

Taxable Payments Reporting

Back Charges

Batch and Journal Reports

This Product Guide address the Tables and Setup aspects of the Accounts Payable module.

Tables

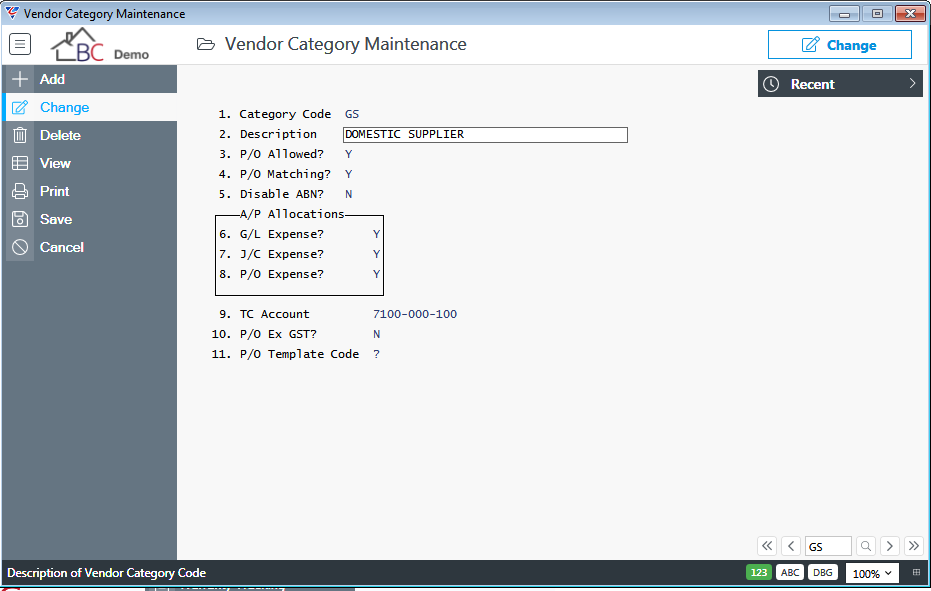

Categories

Categories are used to classify vendors for reporting purposes, but more importantly to determine various settings for vendors assigned to that category.

Go to Accounts Payable > Tables > Categories:

| Category Code | A 2-character alphanumeric code used to identify the Category. |

| Description | A 40-character field used to describe the Category. |

| P/O Allowed? | Indicates if Purchase Orders can be created for Vendors assigned to this Category (Y), whether a warning is provided of the vendor category when creating a Purchase Order (W) or Purchase Orders cannot be created for vendors assigned to this category (N). |

| P/O Matching? |

Indicates if Purchase Orders can be matched to Accounts Payable invoices for Vendors assigned to this Category. Options are – Accounts Payable Invoice and Purchase Order Vendor Codes must match (Y), Accounts Payable Invoice and Purchase Order Vendor Categories must match (C) or Accounts Payable and Purchase Order matching is not permitted for vendors assigned to this category (N). |

| Disable ABN? | Indicates whether ABN Checking and Withholding Tax is disabled for Vendors assigned to this category (Y) or not (N). This option is typically used for Vendor Categories for Overseas Suppliers. |

AP Allocations

| G/L Expense | Indicates whether Accounts Payable Invoices can be distributed to General Ledger Expenses using the Expenses (F5) function key in the Invoice Entry screen (Y) or not (N). |

| J/C Expense | Indicates whether Accounts Payable Invoices can be distributed to Jobs using the Jobs (F6) function key in the Invoice Entry screen (Y) or not (N). |

| P/O Expense | Indicates whether Accounts Payable Invoices can be matched to Purchase Orders using the Purch (F7) function key in the Invoice Entry screen (Y) or not (N). |

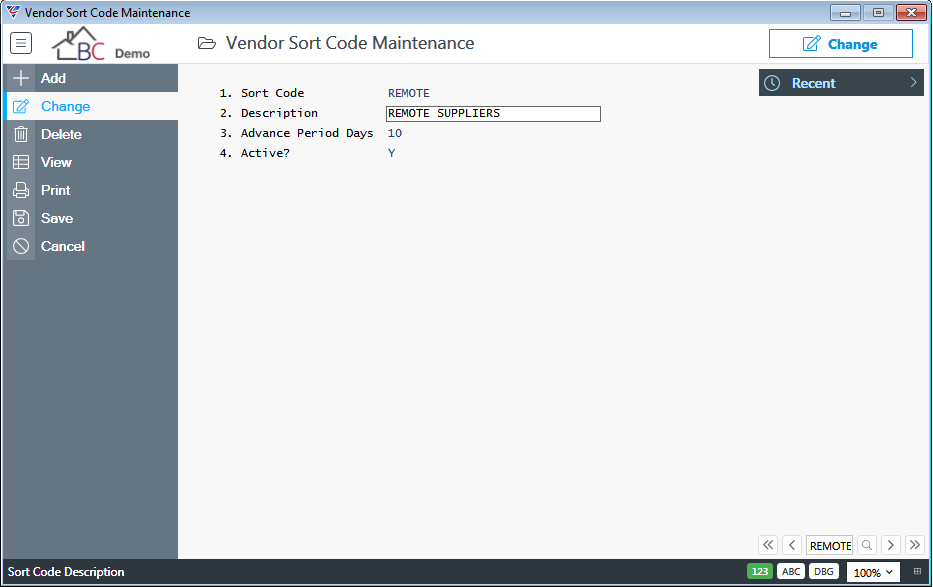

Sort Codes

Sort Codes are used to classify vendors for reporting purposes with an option to relax invoice entry date for vendors assigned to that sort code.

Go to Accounts Payable > Tables > Sort Codes:

| Sort Code | A 2-digit alphanumeric code used to identify the Sort Code. |

| Description | A 30-alphanumeric description for the Sort Code. |

| Advance Period Days | When Date Checking is used, a check is performed to ensure transaction creation dates are within the current period. The Advance Period Days provides the option to relax that check by the number of days specified (0-99) or by a month (M) for vendors assigned to this Sort Code. |

| Active | Indicates whether the Sort code is Active (Y) or not (N). |

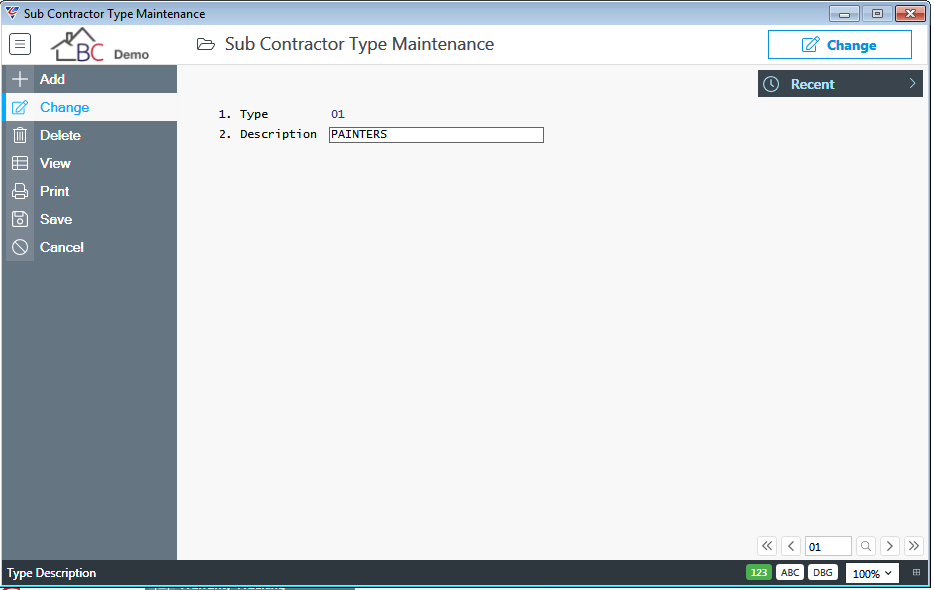

Sub Contractor Types

Sub Contractor Types are used to classify vendors flagged as Subcontractors primarily for reporting purposes.

Go to Accounts Payable > Tables > Sub Contractor Types:

| Type | A 2-digit alphanumeric code used to identify the Sub Contractor Type. |

| Description | A 30-alphanumeric description for the Sub Contractor Type. |

Setup

The Setup menu of the Accounts Payable module comprises a range of screens for Standing Supplier Invoices, Supplier Imports and Exports, Open Item and History Transaction Purge, Integrity Checks in addition to Default, Interface and Setup screens.

Standing Supplier Invoices

Standing Supplier Invoices provide the option to set up recurring supplier invoices (including negative amounts to cater for recurring credits) for use in the Accounts Payable > Transactions > Invoice Entry screen.

To set up Standing Supplier Invoices, go to Accounts Payable > Setup > Standing Supplier Invoices and click Add in the Menu Sidebar to create a new standing supplier invoice.

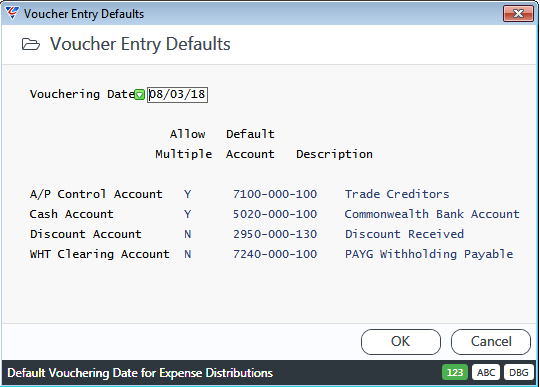

The Voucher Entry Defaults screen appears. Check the defaults are correct for the Standing Supplier Invoices about to be set up and then click OK (F12):

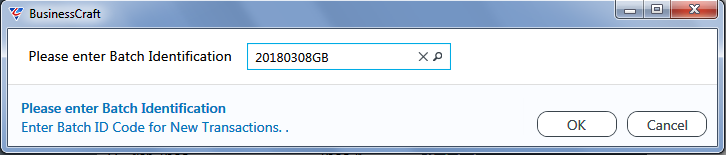

Enter/select a Batch ID for the Standing Supplier Invoices to be created. Standing Supplier Invoices can be added to existing Batch IDs or new Batch IDs created:

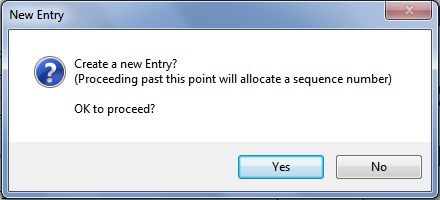

After entering/selecting the Batch ID, acknowledge the prompt to create the Batch ID if it doesn’t exist. A prompt appears to create a new Standing Supplier Invoice Entry:

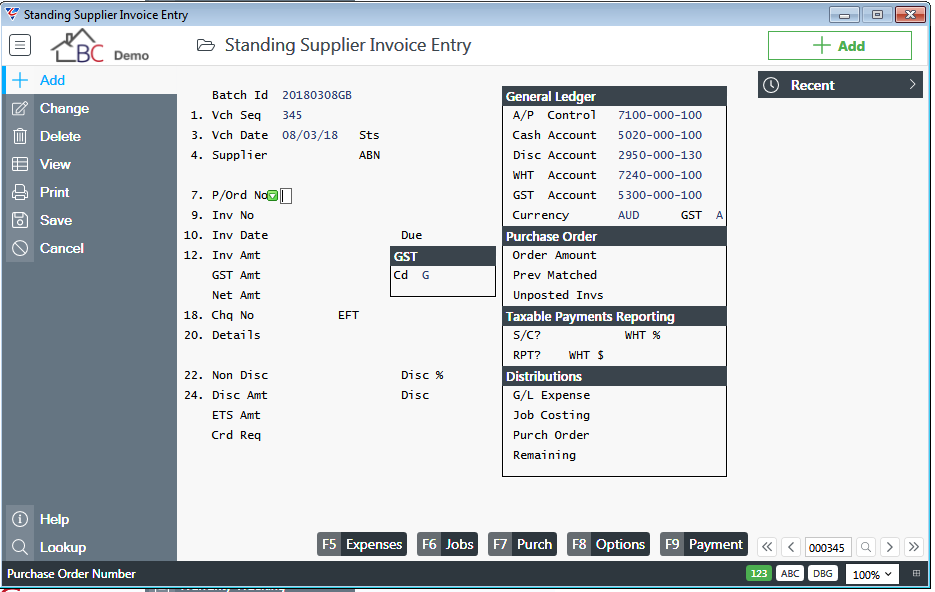

Acknowledge the prompt by clicking Yes to proceed and the Standing Supplier Invoice Entry screen is displayed in Add Mode with the Batch ID, Voucher Sequence, Voucher Date, GST Code and General Ledger Panel fields populated.

Subject to the way in which the Accounts Payable > Setup > Defaults > Voucher Entry Option is set, the cursor will be positioned at either the Purchase Order Number field or the Supplier field:

| Batch ID | The Batch ID entered/selected is displayed. |

| Vch Seq | The next available voucher sequence number is displayed. |

| Vch Date | The Vouchering Date provided in the Voucher Entry Defaults screen is displayed can be can be changed for each Standing Supplier Invoice created. |

| Supplier |

If a Purchase Order was already entered, then the Purchase Order Supplier is displayed but can be overwritten if required. If the Supplier Code does not have a valid ABN, a warning is displayed that Withholding Tax will be applied. The ABN field is populated with the Withholding Rate, the WHT% is populated with the default WHT % but can be changed and the WHT $ field shows the calculated WHT amount. |

| ABN | The ABN for the Supplier Code is displayed. If the Supplier does not have a valid ABN then the Default WHT % is displayed. |

| P/Ord No | If the Standing Supplier Invoice is for a specific Purchase Order, enter/select the Purchase Order Number. The User ID that created the Purchase Order is displayed to the right of the entered Purchase Order number. |

| Inv No | If the Standing Supplier Invoice is for a specific Supplier Invoice Number, enter the Invoice Number, otherwise leave blank. |

| Inv Date | If the Standing Supplier Invoice is for a specific Supplier Invoice, enter the Invoice Date, otherwise leave blank and the Inv Date field will be populated with the Vch Date. |

| Due | The Due Date for the Invoice is automatically calculated by applying the Due Days and Ageing Method for the Vendor to the Inv Date. The Due Date can be overwritten; however, this is not important for Standing Supplier Invoices. |

| Inv Amt |

Enter the Default Invoice Amount (including GST) for the Standing Supplier Invoice. Please note that if GST is not applied to the Total Invoice Amount, pressing F10 on the Inv Amt field will open the GST Calculator screen so that the GST breakdown can be entered. |

| GST Code | The GST Code will default from the Supplier, but will display an asterisk next to the code if the GST Calculator has been used. The GST Rate for the GST code is displayed. |

| GST Amt | The GST Amount will be displayed based on the Invoice Amount and GST Code unless the GST Calculator has been used in which case the amount determined in that screen will be used. |

| Net Amt | The Invoice Amount excluding GST is displayed. |

| Chq No | The Cheque Number is used to record a nominal number to indicate the invoice is to be processed as paid when entered and posted in the Invoice Entry screen. |

| EFT | The EFT Reference to be recorded in the ABA file when this Invoices created from this Standing Supplier Invoice are paid via EFT. The EFT reference defaults from the Vendor or if blank from Accounts Payable EFT Setup. If required a specific EFT reference can be recorded for this Standing Supplier Invoice. |

| Details | Two 30 character fields to record additional details related to this Standing Supplier Invoice. |

| Non Disc | The portion of the Invoice Net amount that does not attract discount. |

| Disc % | The percentage discount to be applied to the Invoice Net Amount excluding the Non Disc amount. |

| Disc Amt | The calculated discount for the Standing Supplier Invoice. |

| Disc | The date by which the invoice must be paid to claim the Discount. |

General Ledger

| A/P Control | The General Ledger Account to be used for Accounts Payable Control Account purposes. Populated from Voucher Entry Defaults. |

| Cash Account | The General Ledger Account to be used for Vendor Payments. Populated from Voucher Entry Defaults. |

| Disc Account | The General Ledger Account to be used for discounts allowed on Vendor Invoices and Credit Notes. Populated from Voucher Entry Defaults. |

| WHT Account | The General Ledger Account to be used for Withholding Tax. Populated from Voucher Entry Defaults. |

| GST Account | The General Ledger Account to be used for GST. Populated from the Goods and Services Tax Control screen accessed from Business Activity > Setup > GST Setup. |

| Currency | If Foreign Currency is enabled, the Currency for the Supplier. Can be changed if required. |

| GST | The GST Method at the time the Standing Supplier Invoice was created. Populated from the Goods and Services Tax Control screen accessed from Business Activity > Setup > GST Setup. |

Purchase Order

| Order Amount | Not used in Standing Supplier Invoices. |

| Prev Matched | Not used in Standing Supplier Invoices. |

| Unposted Invs | Not used in Standing Supplier Invoices. |

Taxable Payments Reporting

| S/C | Indicates whether the Vendor for the Invoice is a Subcontractor (Y) or not (N). |

| RPT | Indicates whether the Invoice is Reportable for Taxable Reporting Purposes (Y) or not (N). Can be changed for individual invoices. |

| WHT % | The Withholding Tax Percentage for the Invoice. This can be due to a supplier not providing an ABN or entering a Voluntary Withholding Tax arrangement. Can be changed for individual invoices. |

| WHT $ | The calculated Withholding Tax Amount is displayed. |

Distributions

| G/L Expense | The portion of the Invoice Net amount allocated to a General Ledger account using the Expenses (F5) function key. |

| Job Costing | The portion of the Invoice Net amount allocated to a Job using the Jobs (F6) function key. |

| Purch Order | The portion of the Invoice Net amount match to a Purchase Order using the Purch (F7) function key. |

| Remaining | The portion of the Invoice Net amount remaining to be allocated to a General Ledger Expense Account, to a Job or matched to a Purchase Order. |

Expenses (F5)

Use this function key to allocation all or part of the Invoice Net Amount to one or more General Ledger Accounts.

Job (F5)

Use this function key to allocation all or part of the Invoice Net Amount to one of more Jobs.

Purch (F7)

Use this function key to match all or part of the Invoice Net Amount to one of more Purchase Order Lines.

Options (F8)

Not applicable to Standing Supplier Invoices.

Payment (F9)

Not applicable to Standing Supplier Invoices.

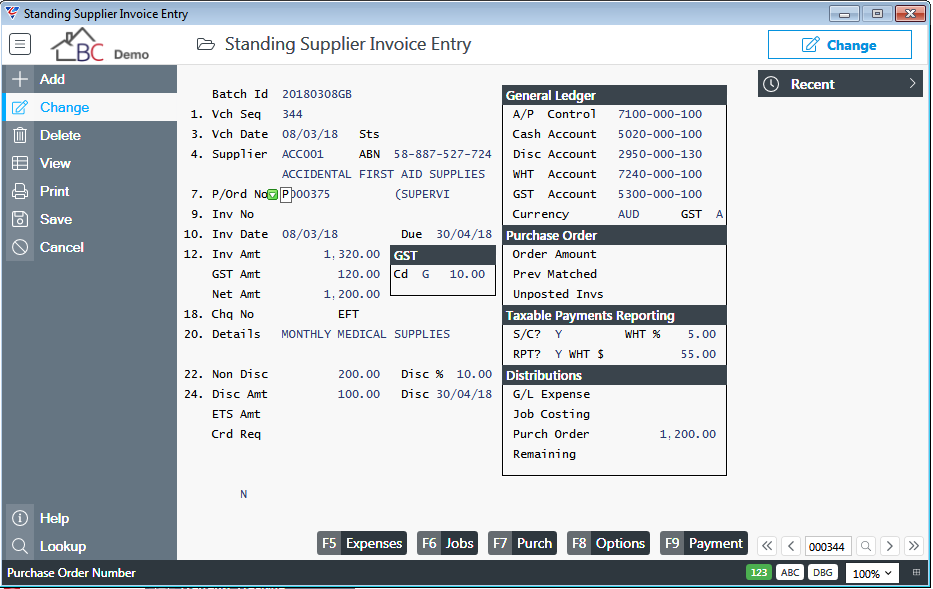

Example of a Completed Standing Supplier Invoice

Here is a completed Standing Supplier Invoice ready for use in Accounts Payable > Transactions > Invoice Entry:

Import Vendors

The Import Vendors menu item provides the ability to import Vendors rather than use the Maintain Vendors screen within the Maintain menu. Import Vendors is generally used when setting up the Accounts Payable module.

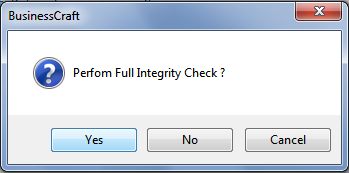

Go to Accounts Payable > Setup > Import Vendors and a prompt is provided to carry out an Integrity Check as part of the import process:

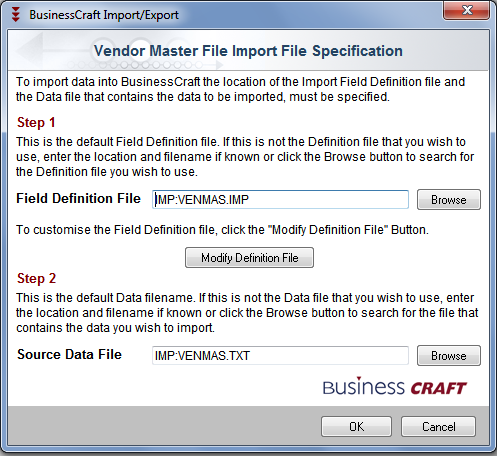

After determining whether to run an Integrity Check or not, the Vendor Import File Specification screen will be displayed. The Import process uses the standard BusinessCraft import process found throughout the BusinessCraft system:

Export Vendors

The Export Vendors menu item provides the ability to export Vendors for a range of purposes including corrections and re-importing.

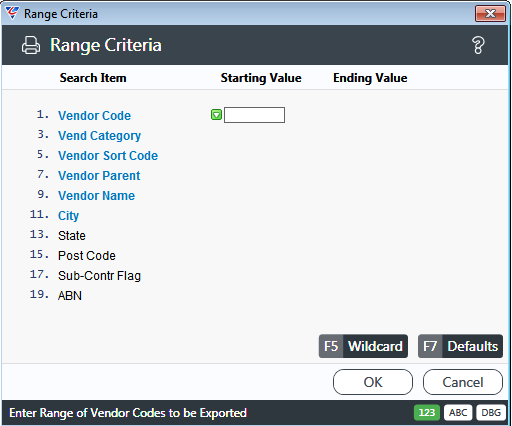

Go to Accounts Payable > Setup > Export Vendors and a range criteria screen provides the ability to limit the export to specific vendors:

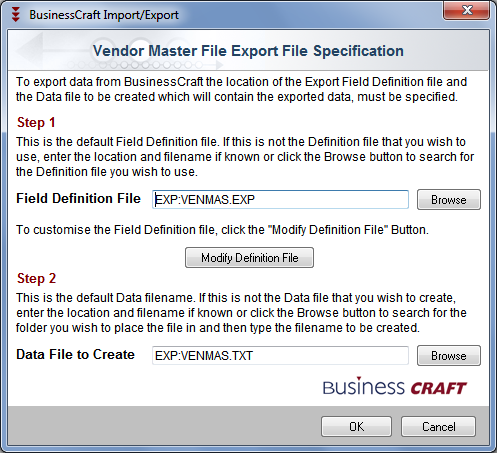

After specifying range criteria, the system displays the Vendor Master File Export File Specification screen. The Export process uses the BusinessCraft standard export process used throughout the BusinessCraft system:

:

:

Purge Open Items

Purge Open Items provides the option to carry out the purging of fully paid Accounts Payable Open Items separate from the Period End process.

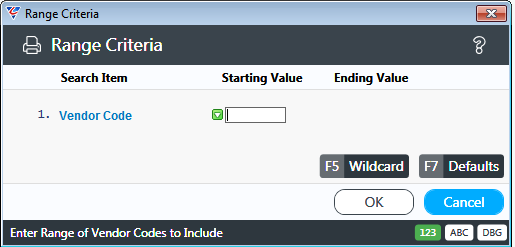

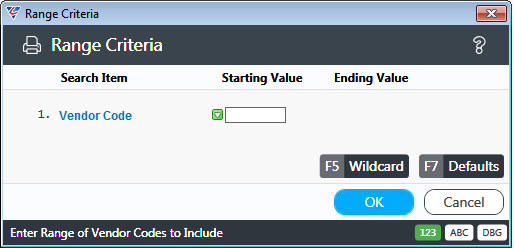

Go to Accounts Payable > Setup > Purge Open Items and a Range Criteria screen is displayed providing the option to limit the purge to certain vendors:

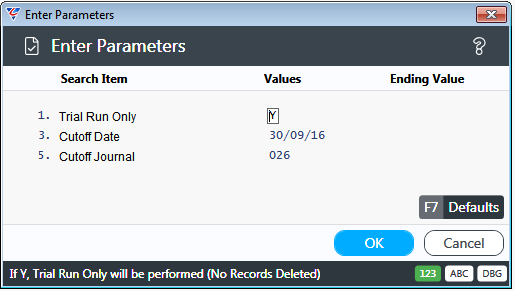

After entering any required Range Criteria, a Parameters screen is displayed:

| Trial Run Only | Indicates if the Purge Open Items process is to be carried out as a Trial Run (Y) or not (N). A Trial Run will produce a Trial Run report and not Purge any Open Items. |

| Cutoff Date | The Cutoff Date is populated automatically by offsetting the first day in the Accounts Payable Current Period by the value in the A/P Open Months to Keep field. The Cutoff Date can be changed to an earlier date but not a later date. |

| Cutoff Journal | The Cutoff Journal is populated automatically by offsetting the Accounts Payable Current Journal so that the A/P Open Months to Keep are observed. For example, if the Current Journal is 30 and the A/P Months to Keep is 3, then Journals 27, 28, and 29 (besides 30) must be retained so the cutoff Journal will be 26. |

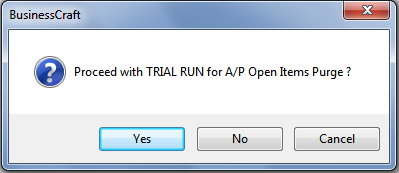

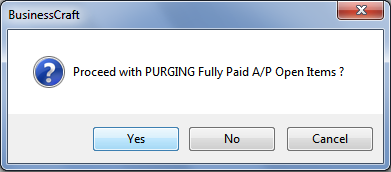

After updating any required parameters and clicking OK, one of two prompts will appear requiring confirmation to proceed with the Purge Open Items process:

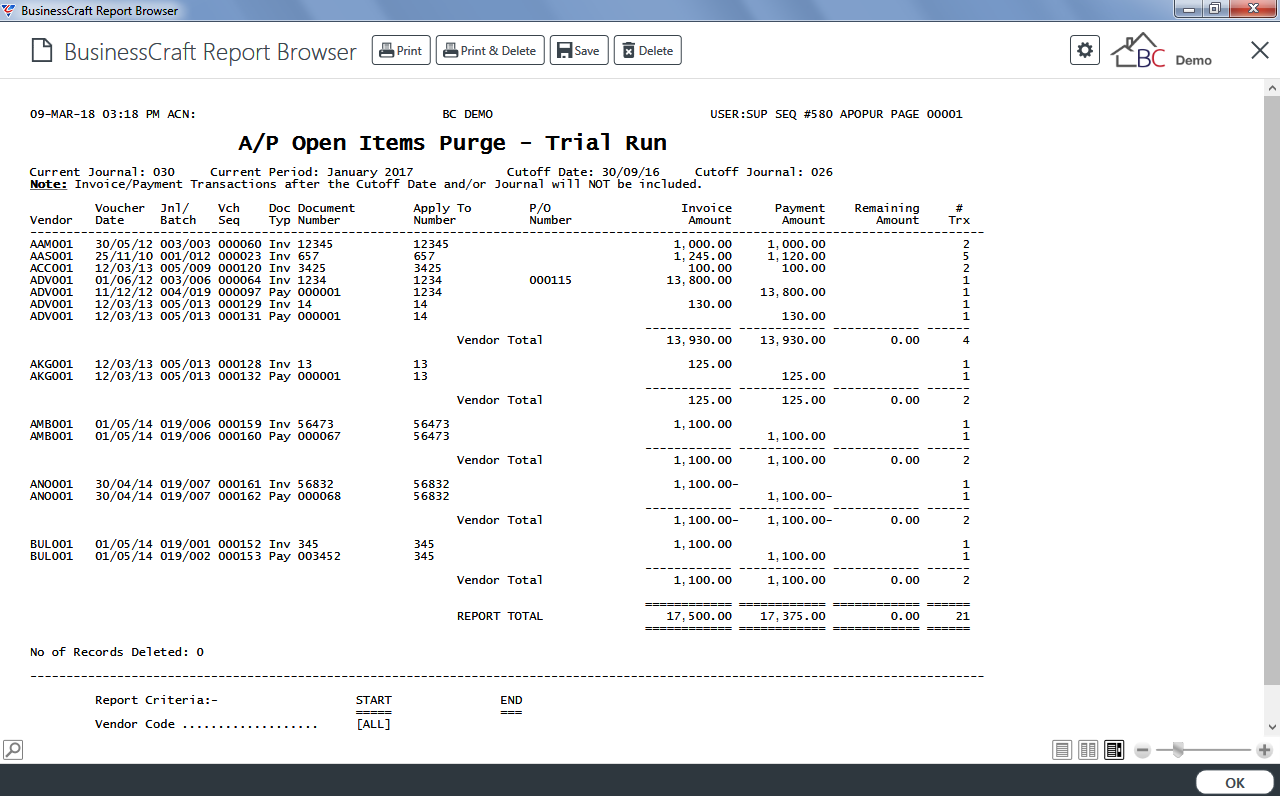

For Trial Runs, the A/R Open Items Purge – Trial Run report is displayed:

For non-trial runs, the process is carried out without further prompts or a report.

Purge History

The History/Distribution Purge process provides the option to purge Accounts Payable History and Distributions but this should only be carried out in exceptional circumstances.

Go to Accounts Payable > Setup > Purge History:

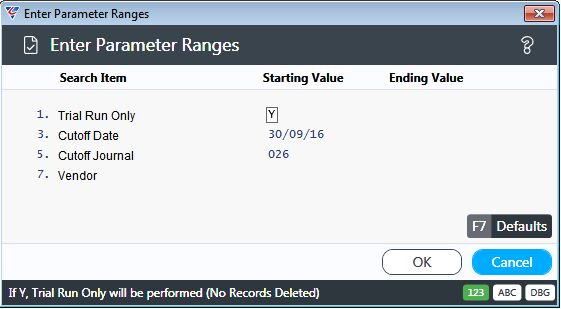

A Parameters screen is displayed providing the option to limit the purge process:

| Trial Run Only | Indicates if the History/Distribution Purge process is to be carried out as a Trial Run (Y) or not (N). A Trial Run will produce a Trial Run report and not Purge any History/Distributions. |

| Cutoff Date | The Cutoff Date is populated automatically by offsetting the first day in the Accounts Payable Current Period by the value in the Purge Months to Keep field. |

| Cutoff Journal |

The Cutoff Journal is populated automatically by offsetting the Accounts Payable Current Journal so that the Purge Months to Keep are observed. For example, if the Current Journal is 30 and the A/P Months to Keep is 3, then Journals 27, 28, and 29 (besides 30) must be retained so the cutoff Journal will be 26. |

| Vendor | Provides the option to limit the Purge to a specific Vendor range. |

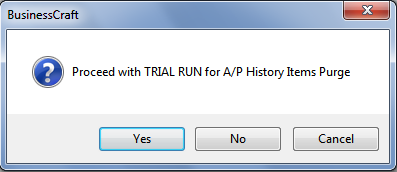

If Trial Run Only was set to Y, a prompt is displayed for the History Purge:

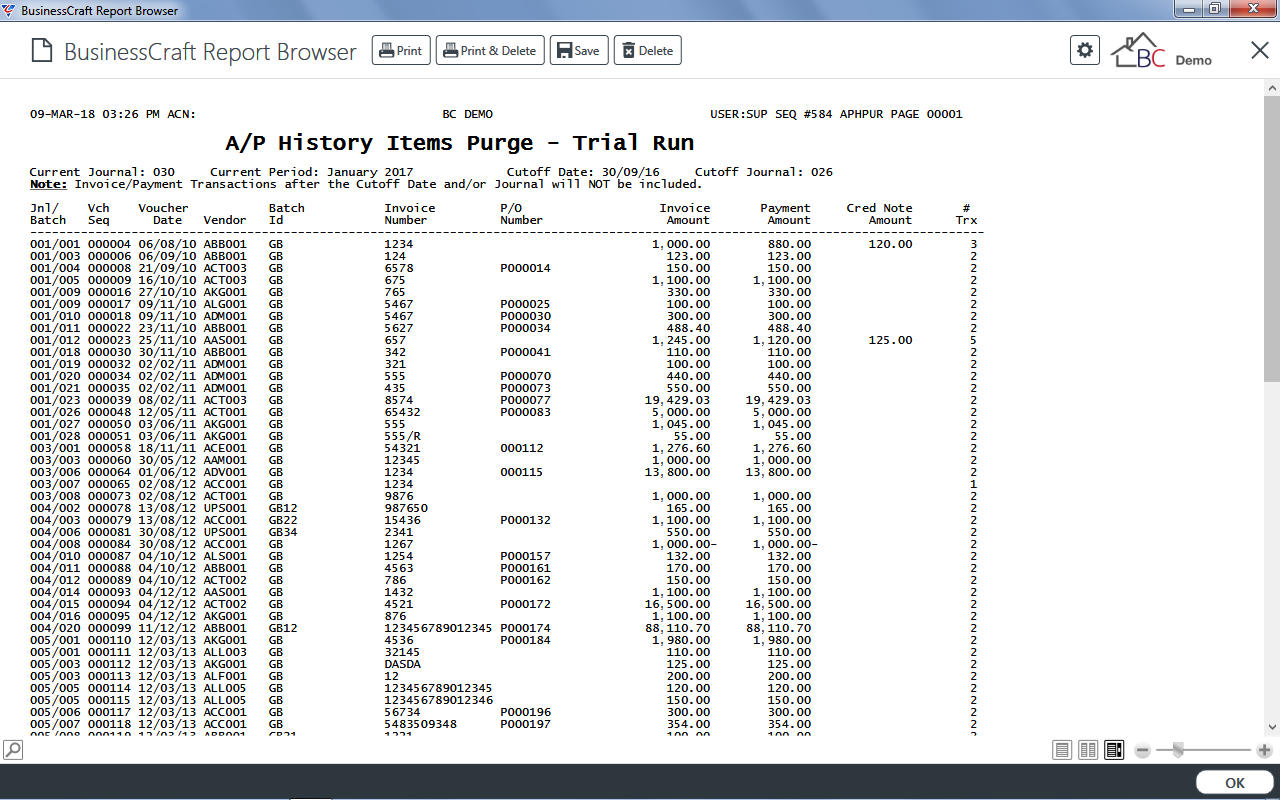

Followed by the A/P History Items Purge – Trial Run report:

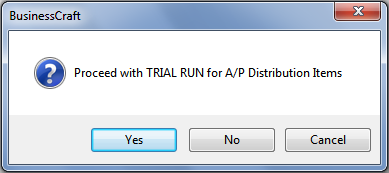

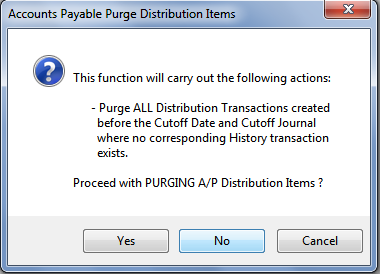

After exiting the BusinessCraft Report Browser, a prompt is displayed for the Distributions Purge:

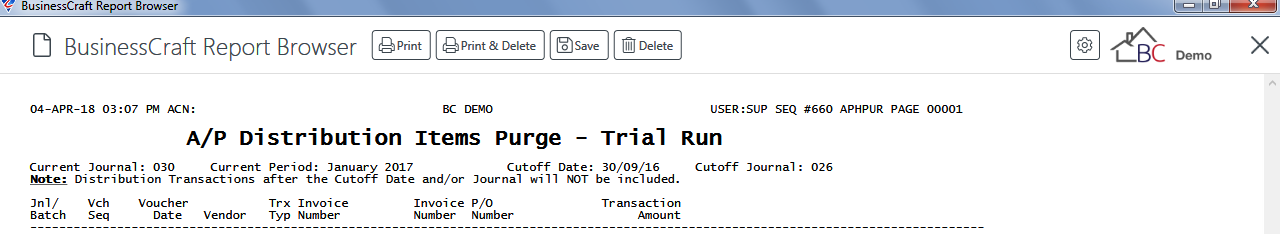

Followed by the A/P History Items Purge – Trial Run report:

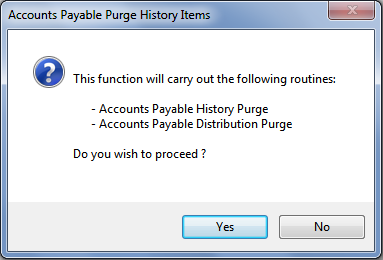

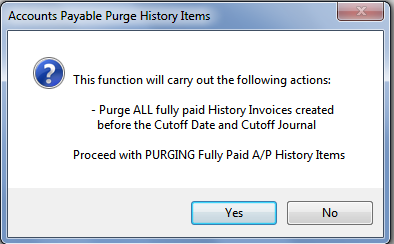

If Trial Run Only was set to N, a warning prompt is displayed showing the actions that will be carried out in relation to History:

and then for Distributions:

The process is carried out without further prompts or a report for History and/or Distributions.

Vendor Integrity Check

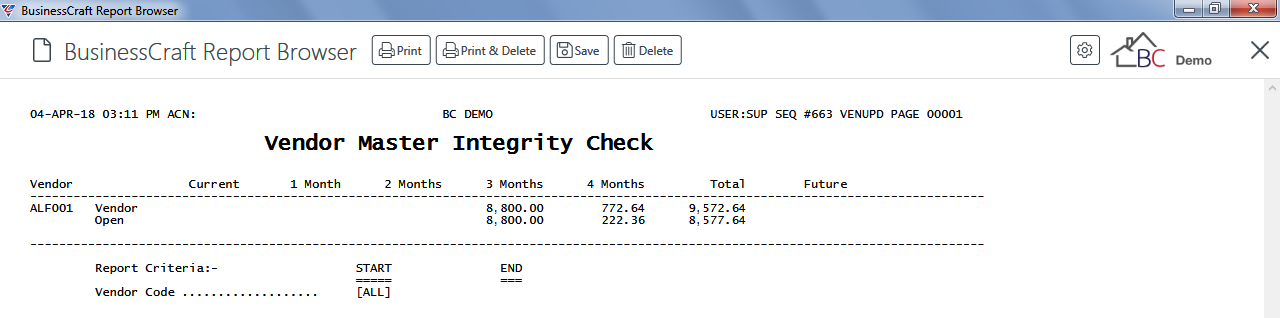

The Integrity Check updates the Aged Balances stored in the Vendor Master File Maintenance screen based on Open Item records.

Go to Accounts Payable > Setup > Integrity Check and a Parameters screen provides the option to carry out the Integrity Check for a subset of suppliers:

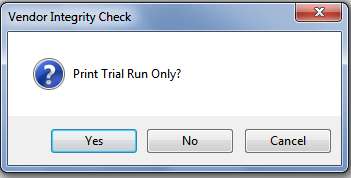

After clicking OK, a prompt is provided to carry out a trial run:

If a Trial Run or Live run is carried out, the Vendor Master Integrity Check report:

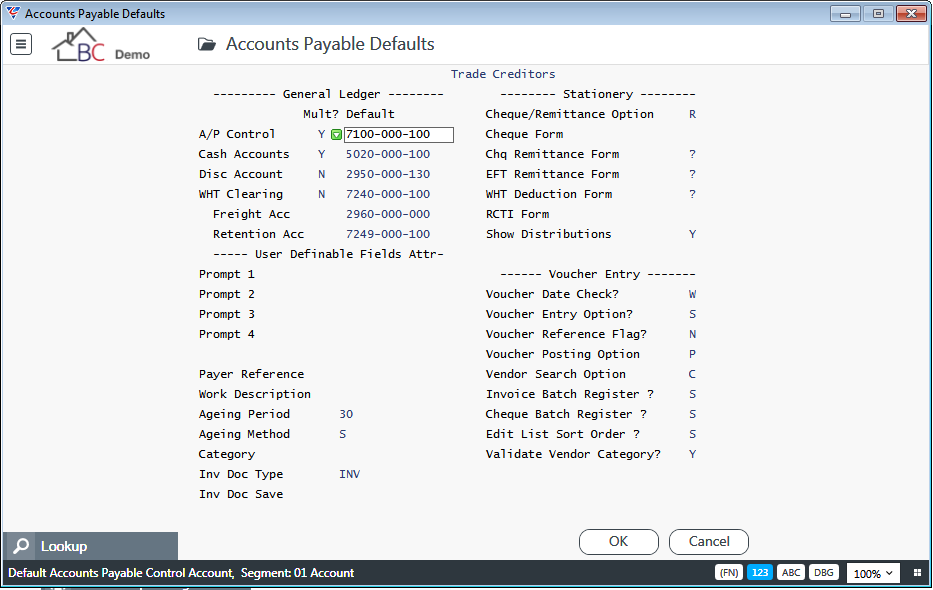

Defaults

Prior to using the Accounts Payable module, it is important to ensure the module is configured correctly. As part of the configuration go to Accounts Payable > Setup > Defaults:

General Ledger

| Mult ? | Indicates if more than one General Ledger account can be used besides the default account in the Default column (Y) or not (N). |

| A/P Control | The default General Ledger Account to be used for Accounts Payable Control Account purposes unless an account is specified for the Vendor Category assigned to the Vendor. |

| Cash Accounts | The default General Ledger Account to be used for Vendor Payments. |

| Disc Account | The default General Ledger Account to be used for discounts allowed on Vendor Invoices and Credit Notes. |

| WHT Clearing | The default General Ledger Account to be used for Withholding Tax amounts applicable to Vendor Invoices. |

| Freight Acc | The General Ledger Account to be used for recording Freight for Shipping Adjustments. |

| Retention Acc | No longer used – to be removed in a future version |

User Definable Fields

| Prompt 1 | The label for the first user definable field on Page 2 of the Vendor Maintenance screen. An Attribute field is provided to the right to indicate whether the field is a 15-character alphanumeric (blank) or a date field (J). |

| Prompt 2 | The label for the second user definable field on Page 2 of the Vendor Maintenance screen. An Attribute field is provided to the right to indicate whether the field is a 15-character alphanumeric (blank) or a date field (J). |

| Prompt 3 | The label for the third user definable field on Page 2 of the Vendor Maintenance screen. An Attribute field is provided to the right to indicate whether the field is a 15-character alphanumeric (blank) or a date field (J). |

| Prompt 4 | The label for the fourth user definable field on Page 2 of the Vendor Maintenance screen. An Attribute field is provided to the right to indicate whether the field is a 15-character alphanumeric (blank) or a date field (J). |

| Payer Reference | The Payer’s ABN or Withholding Payer Number (WPN) to be quoted on PAYG Payment Summary – withholding where ABN not quoted forms. |

| Work Description | No longer used – to be removed in a future version |

| Ageing Period | The default number of days used for ageing calculations in conjunction with the Ageing Method assigned to vendors when created. |

| Ageing Method |

The default method used to calculate invoice due dates in conjunction with the Ageing Period assigned to vendors when created. Options are - from the Invoice Date (I) or from the last calendar day of the month for the Invoice Date (S). |

| Category | The default category assigned to vendors when created. |

| Inv Doc Type | Enter/select the Document Type to be used for Accounts Payable Document Register lines. |

| Inv Doc Save |

An Environment Variable that controls the output location and filename of Posted Accounts Payable Invoice Document Register lines when the Inv Doc Type field is used. The translation of this value will be used to define the filename and path instead of the default. If an Environment Variable is not used, the default location will be the Inv Doc Type Path + Journal Year and Month folder. The default filename is VendorCode_VoucherNumber_Sequence. If an Environment Variable is used, it is recommended the Accounts Payable document register sequence token (#APIDA_SEQ#) is used to ensure unique filenames. Example: Result: Q:\JobDocs\001718\AP_Invoices\1718_505_01_REECE_545742_10.pdf |

Stationery

| Cheque/Remittance Option | Indicates that when payments are made is a Remittance Only sent (R), a Remittance sent with a Cheque attached (C) or a Remittance is sent with a separate cheque (S). |

| Cheque Form | Indicates the form to be used when printing Cheques/Remittances. Options are Cheque Form (1), Cheque Remittance Form (2) or EFT Remittance (3). |

| Chq Remittance Form | The Default Layout for remittances when payment is not made by EFT. Record the Template Layout code or ? for the user to be prompted to choose a layout. |

| EFT Remittance Form | The Default Layout for remittances when payment is made by EFT. Record the Template Layout code or ? for the user to be prompted to choose a layout. |

| WHT Deduction Form | The Default Layout for PAYG Payment Summary – withholding where ABN not quoted forms. Record the Template Layout code or ? for the user to be prompted to choose a layout. |

| RCTI Form | The Default Layout for Recipient Generated Tax Invoices. Record the Template Layout code or ? for the user to be prompted to choose a layout. |

| Show Distributions | Indicates whether distributions are shown on Remittances (Y), are shown based on the Vendors Settings (V) or not at all (N). |

Voucher Entry

| Voucher Date Check |

Denotes whether a check is performed to ensure transaction creation dates are within the current period. Options are No Check (N), Warning (W), Password (P) & Force (F). |

| Voucher Entry Option | Indicates whether Date and Vendor fields are skipped when adding an invoice in Invoice entry and cursor is positioned on the Purchase Order field (S) or not (blank). If Streamlined (S) option is used, vendor and date fields can still be accessed. |

| Voucher Reference Flag | Indicates whether The Reference field is populated with the Purchase Order number where available (P) or not populated (N). |

| Voucher Posting Option | Indicates whether created batches are posted (P) or where the dataset is a remote branch then the batch on posting is moved to a transfer area (R). |

| Vendor Search Option | No longer supported. To be removed in a future version. |

| Invoice Batch Register |

Indicates the way the Batch Register is printed on completion of invoice posting. Options are – Not Printed (N), Full Details printed (F), Full Details printed with a new page for each Vendor (P), Full Details printed with a prompt to print new page for each Vendor (?), Summary printed (S). Batches can be printed subsequently if required. |

| Cheque Batch Register |

Indicates the way the Batch Register is printed on completion of payment posting. Options are – Summary of Payments with Invoices paid (C), Not Printed (N), Full Details printed (F), Full Details printed with a new page for each Vendor (P), Full Details printed with a prompt to print new page for each Vendor (?), Summary printed (S). |

| Edit List Sort Order | Indicates whether the Invoice Edit List is printed in Supplier Code Order (S), Voucher Sequence (V) or to be prompted when printing for sort order (?) |

| Validate Vendor Category | Indicates whether Vendor Categories are checked (Y) or not (N). |

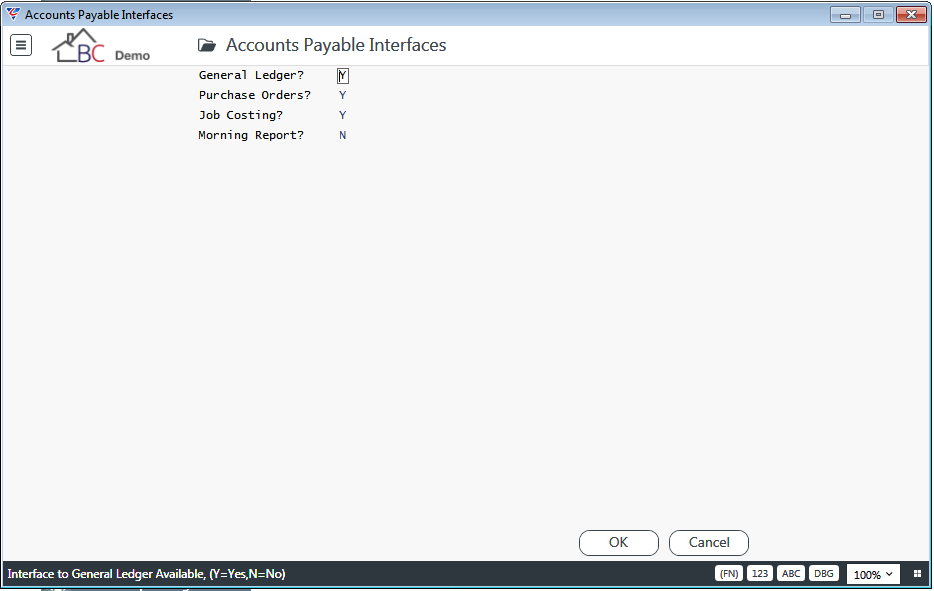

Interfaces

Prior to using the Accounts Payable module, it is important to ensure the module is configured correctly. As part of the configuration go to Accounts Payable > Setup > Interfaces:

| General Ledger | Indicates if the Accounts Payable module is integrated with the General Ledger (Y) or not (N). |

| Purchase Orders | Indicates if the Accounts Payable module is integrated with the Purchase Orders module (Y) or not (N). |

| Job Costing | Indicates if the Accounts Payable module is integrated with the Job Costing module (Y) or not (N). |

| Morning Report | No longer supported. Will be removed in a future version. |

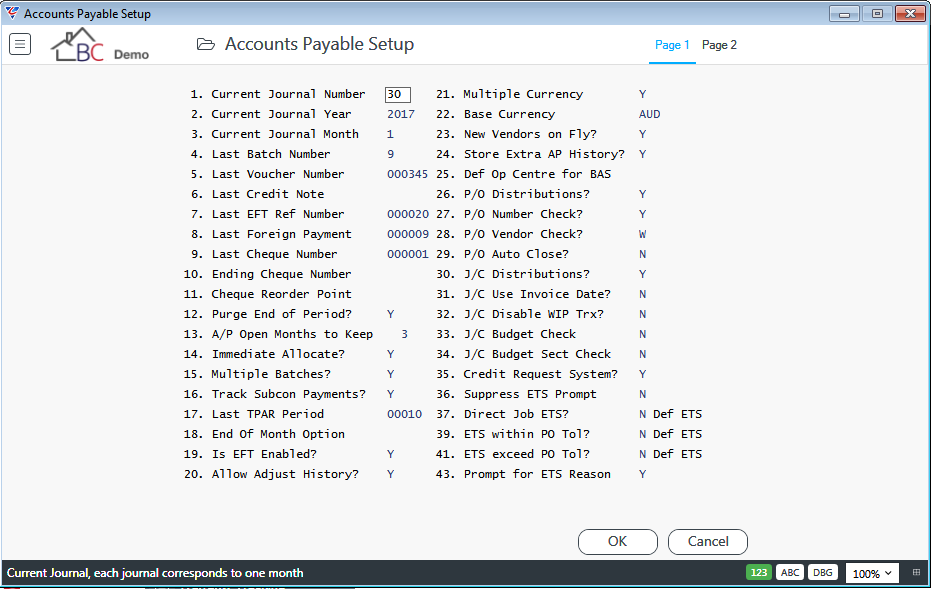

Setup

Prior to using the Accounts Payable module, it is important to ensure the module is configured correctly. As part of the configuration go to Accounts Payable > Setup > Setup:

Setup - Page 1

| Current Journal Number | On initial setup, set to 1. The system will automatically increment this value each time Accounts Payable End of Month is run. |

| Current Journal Year | The current calendar year for the Accounts Payable Module. The system will automatically increment this value when the current journal month is the last month in the year and Accounts Payable End of Month is run. |

| Current Journal Month | The current calendar month for the Accounts Payable Module. The system will automatically increment this value each time Accounts Payable End of Month is run. |

| Last Batch Number | Each transaction belongs to a journal and a unique batch of transactions. On initial setup, this field can be left blank. The last batch number is reset to zero (blank) when Accounts Payable End of Month is run. |

| Last Voucher Number | Each invoice belongs to a journal and a unique batch of transactions and is assigned a voucher number. On initial setup, this field can be left blank. |

| Last Credit Note | Each credit note belongs to a journal and a unique batch of transactions and is assigned a credit note number. On initial setup, this field can be left blank. |

| Last EFT Ref Number | Each payment transaction is assigned a sequential number. When paid by EFT, the last payment transaction is updated in this field so that the next EFT payment number can be sequentially assigned. On initial setup, this field can be left blank. |

| Last Foreign Payment | Each payment transaction is assigned a sequential number. When a Foreign Payment is made, the last payment transaction is updated in this field so that the next Foreign Payment number can be sequentially assigned. On initial setup, this field can be left blank. |

| Last Cheque Number | Each payment transaction is assigned a sequential number. When paid by cheque, the last payment transaction is updated in this field so that the next cheque payment number can be sequentially assigned. On initial setup, this field can be left blank. |

| Ending Cheque Number | The last cheque number in the current book of cheques. |

| Cheque Reorder Point | The number of cheque numbers left before a warning is provided. |

| Purge End of Period | Indicates if eligible Fully Paid Open Items are purged as part of the End of Month process (Y) or not (N). |

| A/P Months to Keep | The number of months of fully paid open items to be retained when the Purge Open Items process is run. |

| Immediate Allocate | Indicates whether voucher numbers are assigned on voucher creation (Y) or not (N). |

| Multiple Batches | Indicates if multiple batches can be open when entering transactions (Y) or not (N). |

| Track Subcon Payments | Indicates if payments to subcontractors are tracked for Taxable Payments Reporting purposes (Y) or not (N). |

| Last TPAR Period | The Last TPAR Period field should be blank unless the system was previously used to report subcontractor payments under previous legislation. In any event, this field should not be changed. When the Taxable Payments Annual Report is prepared for submission, this field will be incremented. |

| End of Month Option | Indicates whether the Accounts Payable Control Total will be displayed during the End of Month process with an option to discontinue End of Month (blank) or not (S). |

| Is EFT Enabled | Indicates if Electronic Funds Transfers (EFT) are carried out using the Bank Account specified in the succeeding pop up window (Y), using multiple bank accounts from which one is selected during the payment process (M) or not used (N). |

| Allow Adjust History | Indicates whether unprotected edit mode changes are permitted to the Accounts Payable Module. This should be set to N to preserve Accounts Payable Module integrity. |

| Multiple Currency | Indicates whether multiple currencies are used in the Accounts Payable module (Y) or not (N). |

| Base Currency | If the Multiple Currency field is set to Y, enter/select the Home Currency for the dataset. |

| New Vendors on Fly | Indicate whether new vendors can be entered during Invoice entry (Y) or not (N). |

| Store Extra AP History | Indicates if history is kept of voucher lines as well as voucher headers (Y) or not (N). Must be set to Y if Inter-Company Accounts Payable function is used. |

| Def Op Centre for BAS | Enter/select the default Operating Centre for Business Activity records triggered from the Accounts Payable module. |

| P/O Distributions | Indicates whether Accounts Payable invoices can be distributed to one or more Purchase Orders (Y), to only one Purchase Order per Voucher (S) or not (N). |

| P/O Number Check | Indicates whether a warning will be provided when the Purchase Order Number field is left blank during Invoice entry (Y) or not (N). |

| P/O Vendor Check | Indicates whether, in Invoice Entry, the Purchase Order Vendor and Invoice Vendor must match (Y), a warning message is provided that the Purchase Order Vendor and Invoice Vendor do not match (W) or no check is carried out (N). |

| P/O Auto Close | Indicates whether Purchase Orders will be automatically closed when fully matched (Y) or not (N). |

| J/C Distributions | Indicates whether Accounts Payable invoices can be distributed to Jobs (Y) or not (N). |

| J/C Use Invoice Date | Indicates whether the Supplier Invoice Date is used in Job Costing (Y) or if the Voucher Date is used (N). |

| J/C Disable WIP Trx |

Used to indicate whether Job Costing Distributions should not be created when an Accounts Payable document is allocated to a Job (Y) or if Job Costing Distributions should be created (N). When Job Costing is interfaced in Accounts Payable and General Ledger is interfaced in Job Costing, then subject to this setting, Job Costing distributions will be created whenever a voucher is costed to a job. This is in addition to the distributions created in Accounts Payable for a Job Costing transaction. |

| J/C Budget Check | Indicates whether Job Cost Centre Budgets are checked during Invoice Entry (C) or not (N). |

| J/C Budget Sect Check | Indicates if the J/C Budget Check is done for the entered Job Sections during Invoice Entry (Y) or for the Job in total (N). |

| Credit Request System | Indicates whether the Credit Request function is available in the Accounts Payable module (Y) or not (N). |

| Suppress ETS Prompt | Indicates if the ETS prompt is suppressed when using the Credit Request system (Y) or not (N). |

| Direct Job ETS |

Indicates whether ETS transactions are created for each Job Line using the Default ETS Code (Y), prompts for the ETS Code (?) or no ETS is generated (N). Enter/select the Default ETS code in the Def ETS field. |

| ETS within PO Tol |

Indicates whether ETS transactions are created for the difference between the Purchase Order Value and the total of invoices applied to the Purchase Order where the difference is within the Receiving/Matching Tolerance using the Default ETS Code (Y), prompts for the ETS Code (?) or no ETS is generated (N). Enter/select the Default ETS code in the Def ETS field. |

| ETS exceed PO Tol |

Indicates whether ETS transactions are created for the difference between the Purchase Order Value and the total of invoices applied to the Purchase Order where the difference exceeds the Receiving/Matching Tolerance using the Default ETS Code (Y), prompts for the ETS Code (?) or no ETS is generated (N). Enter/select the Default ETS code in the Def ETS field. |

| Prompt for ETS Reason | Indicates whether ETS prompts occur during Invoice Entry (Y) or not (N). |

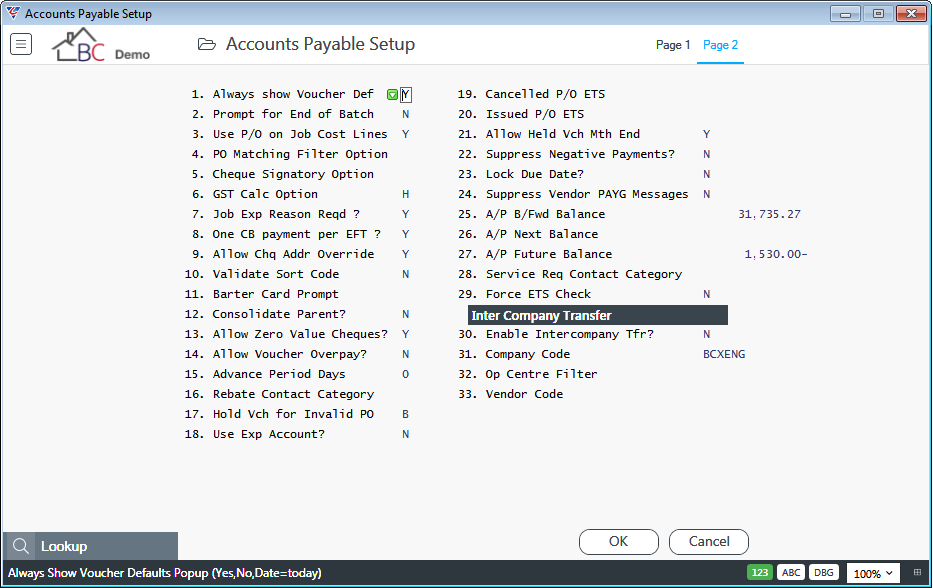

Setup - Page 2

| Always show Voucher Def | Indicates whether the Voucher Entry Defaults pop up is displayed when creating a record in the Supplier Invoice Entry screen (Y), with the Voucher Date populated with the system date (D) or the Voucher Entry Defaults screen is not displayed (N). |

| Prompt for End of Batch | Indicates if the user is prompted to end a batch if the batch ID entered by the user exists (Y) or not (N). If set to N, then the system will delete batches after all records belonging to the batch are posted. |

| Use P/O on Job Cost Lines | Indicates if the Purchase Order Number entered on the Voucher Header is populated on Job Costing Distribution Lines (Y) or not (N). |

| PO Matching Filter Option | Indicates if Purchase Order Matching in Supplier Invoice Entry can be filtered by Purchase Order Receipt Delivery Docket (D) or not (N). (Y) or not (N). |

| Cheque Signatory Option | When printing cheques indicates whether a Signatory Cover sheet is printed (C), a Signatory Summary is printed (S), both reports are printed (B) or no reports are printed (Blank). |

| GST Calc Option | Used to indicate if GST is calculated based on the value on the Invoice header (H) or per invoice line (L). |

| Job Exp Reason Reqd | Indicates whether an Extra to Schedule (ETS) code must be provided when Invoices are distributed to Jobs (Y) or not (N). |

| One CB payment per EFT | Indicates whether one Cashbook Payment transaction is created when Accounts Payable Eft Payments are processed (Y) or not (N). |

| Allow Chq Addr Override | Indicates whether Cheque Addresses can be overridden for Vendors with the Override Address set to Y (Y) or not (N). |

| Validate Sort Code | Indicates whether Sort codes are validated (Y) or not (N) |

| Barter Card Prompt | Used to indicate which of the four User Definable Information fields will contain Barter Card % for the Vendor (1 to 4). Leave blank if Barter Card is not used. |

| Consolidate Parent | Used to indicate whether child vendors are consolidated to parent vendors on the AP Ageing (Detailed) and/or Pre-Cheque reports (Y) or not (N). |

| Allow Zero Value Cheques | Indicates if zero value cheques are permitted (Y) or not (N). |

| Allow Voucher Overpay | Indicates whether invoices can be overpaid in Vendor Payment Selection screen (Y) or not (N). |

| Advance Period Days | When Date Checking is used, a check is performed to ensure transaction creation dates are within the current period. The Advance Period Days provides the option to relax that check by the number of days specified (0-99) or by a month (M). |

| Rebate Contact Category | Enter/select the Contact Category to enable contacts to be filtered to those that can be selected for Supplier Rebates. |

| Hold Vch for Invalid PO | Indicates whether entered vouchers are automatically held for Cancelled Purchase Orders (C), Unissued Purchase Orders (I) or both Unissued and Cancelled Purchase Orders (B). |

| Use Exp Account | Indicates whether the expense account from the Purchase Order Header is used (Y) or the General Ledger account for the Vendor (N). |

| Cancelled P/O ETS | Enter/select the ETS Code for vouchers placed on hold for Cancelled Purchase Orders. |

| Issued P/O ETS | Enter/select the ETS Code for vouchers placed on hold for Issued Purchase Orders. |

| Allow Held Vch Mth End |

Used to indicate the type of check carried out on the voucher date for Held Vouchers during the Accounts Payable Month End Process. Options are:

|

| Suppress Negative Payments | Indicates whether selection of invoices is suppressed in Auto Payment Selection where the total of invoices selected for payment for the vendor total a negative amount (Y) or not (N). |

| Lock Due Date | Indicates whether the calculated due date in Invoice Entry cannot be edited by the user (Y) or if the due date can be changed (N). |

| Suppress Vendor PAYG Messages | Indicates whether PAYG messages are suppressed when running Taxable Payment (Y) or not (N). |

| A/P B/Fwd Balance | The Accounts Payable Control Total at the end of the last period. |

| A/P Next Balance | The Accounts Payable Control Total for the current period. |

| A/P Future Balance | The Accounts Payable Control Total for current and future periods. |

| Service Req Contact Category | Enter/select the Contact Category to restrict contacts to be included in the XML produced for the Service Request Supplier Notices report. |

| Force ETS Check | Indicates whether ETS checks are to be carried out on Held invoices (Y) or not (N). |

Inter Company Transfer

The Accounts Payable Inter Company Transfer function provides the ability to import Accounts Payable invoices from another dataset for the specific purpose of processing payment of those imported invoices.

| Enable Intercompany Tfr | Indicates whether the Intercompany Accounts Payable function is used (Y) or not (N). |

| Company Code | The BusinessCraft dataset from which Accounts Payable Invoices are to be imported into this dataset. |

| Op Centre Filter | Where applicable, the import can be restricted to invoices for jobs for a specific Operating Centre. |

| Vendor Code | The Vendor Code in this dataset that will be used to hold all Inter Company imported Accounts Payable invoices. The original supplier is recorded in the Details field on the imported vouchers. |

Revision 1

15th October 2018